Raising money is a series of trade-offs. Alongside traditional equity and debt, new alternative financing options pop up. They open the door to flexible capital but each comes with trade-offs.

Today you’ll learn where each instrument shines and where it breaks. So you can raise faster, keep records clean, and spend your time building instead of babysitting spreadsheets.

But before getting into alternative financing, let’s figure out traditional financing options.

Equity financing — inviting co-owners, not just cash

When you choose the equity route, you’re essentially sharing the pie so it can grow. You sell a slice of your company in exchange for capital and, ideally, expertise. There’s no repayment schedule, but you give up control: someone else now has a seat at the table.

Equity is often framed as a strategic partnership, but in practice that depends on startup stage and check size. Early investors rarely reshape your business. They do help you get off the ground but strategic advice comes with a lead investor, someone who invests a significant amount. Meanwhile, your first angel investments are likely to only bring $5-10,000.

Let’s break down early VC investors:

- Angels. Usually the first to invest, angels come in when all you have is a small prototype and a good team. Angels not focus as much on your metrics if they believe in the product and the team. They write smaller, faster checks from their own capital. Because of that, they rarely offer deep strategic help. Treat them as early fuel to get things moving.

- Seed/early VC. They enter once there’s some traction: users, revenue, or at least clear proof of demand. Their checks are bigger, but so are the expectations. It’s funds who bring you guidance.

- Alternative financing options. Beyond equity and debt, founders can now raise through tokenized crowdfunding or revenue-based models. These alternative financing platforms open the door to smaller, retail investors. They’re basically replacing what early angels used to do. In other words, they’re an alternative to the first money in, not to institutional VC. We’ll get to alternative equity financing later.

Equity is for founders who want to grow big and fast. If your goal is to build a scalable company, expand into new markets, selling a slice makes a lot of sense. But if you’re running a stable, small-scale business with predictable cash flow, equity is the most expensive way to gain financing. Debt or revenue-based financing can cover short-term needs without permanently giving up ownership.

It works best when the right people join your cap table and help you grow far beyond what you could alone.

Debt financing — fuel without giving up the wheel

Debt gives you capital today in exchange for predictable repayments tomorrow. There’s no dilution, no new co-owners, but you get to worry about paying back the lenders. Banks don’t care if your product launch is delayed or if your sales dip that month – a check is due regardless.

So unlike equity, debt is about stability, not potential. It fits businesses that already have steady cash flow or visible incoming revenue. These companies need capital to operate, not to experiment. That could be a local manufacturer or an e-commerce store debt. But early startups are far too risky for banks. Their revenue is unstable, and they lack collateral, so banks stay away until there’s proof that the model works.

Who you can borrow from:

- Banks. The lowest rates, but the hardest to access. Expect detailed paperwork, collateral, and credit history checks. Banks like predictable, asset-backed businesses.

- Convertible loans. This is a typical way for angel investors to finance a company, so you might think they belong to equity financing. But convertible loans start as debt. A convertible note is technically a loan that turns into equity once the company raises a priced round. If everything goes well, it converts smoothly and nobody pays back the principal. But if things stall, note holders still have creditor rights. They can call the debt and, in extreme cases, push a struggling company into bankruptcy.

- Alternative financing lenders. These are online and fast, with minimal collateral requirements. Interest rates vary: some fintech platforms are now cheaper than banks because smart contracts handle payments automatically, reducing administrative costs and default risk. Others charge more for speed and flexibility. They’re especially useful for short-term cash flow.

Debt works to fund things with clear payback: inventory, marketing, or working capital. But hold off if you’re pre-revenue or if your burn rate is unstable. Even if you can secure a collateralized loan, it’s not always worth it.

Bottom line: debt is for companies that already work. If the engine runs, it can add fuel. If you’re still building it, debt just adds pressure.

Alternative financing options: equity crowdfunding & tokenization

Whichever route you choose, equity or debt, the traditional financing is done through institutions. Even angels have to be accredited investors, and they are usually worth millions of dollars.

Small check retail backers were left and that was no accident. In the early 1900s, the U.S. was flooded with get-rich-quick stock schemes like oil fields that didn’t exist. Thousands of small investors lost their savings. In response, states introduced the first “blue sky” laws, meant to stop promoters from selling investments backed by nothing more than “the blue sky and hot air.”

Those laws worked, but they also built high walls around honest private investing. Only the wealthy and accredited could join early-stage deals, while ordinary supporters had to watch from the sidelines.

Crowdfunding

Today, there is an alternative financing path: equity crowdfunding.

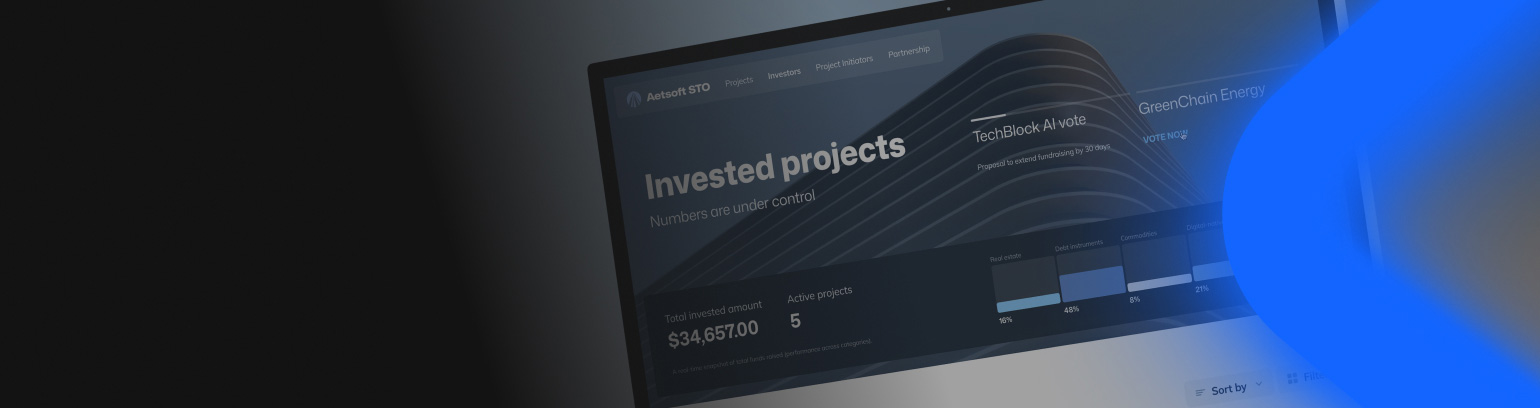

After decades of tight restrictions, updated securities exemptions now allow startups to raise money from retail investors in small amounts. This is done through a regulated Security Token Offering (STO) platform, which operates under national frameworks that replace state-by-state reviews with clear federal guardrails. These regulations cap individual investments, require full disclosure, and enforce KYC/AML checks, making participation finally safe for non-accredited investors.

And this isn’t the old crowdfunding of perks or preorders. Equity crowdfunding and crowdsourcing gives investors real financial rights: equity, future equity, or debt. It’s all issued in compliant digital tokens. Now founders can raise capital in increments as small as $100 instead of $5,000 convertible notes.

It all runs on tokenization. Tokenization turns investor rights into secure, traceable digital instruments: who owns what, when transfers can happen, and how payouts are made. The economics stays the same, but the infrastructure gets smarter. For example, with tokenization, smart contracts can automatically issue tokens to investors and distribute payouts on schedule.

Alternative financing options that run on tokenization

Where angel investors once started at $5,000 checks, tokenized crowdfunding can begin at $100 or even less. It opens access to thousands of small backers. Here are the alternative financing options it enables:

Equity. Investors get real shares, just like in a traditional round. But instead of one big VC, you can have hundreds of small backers. On an STO platform, ownership records are kept as digital tokens that show who holds which shares, when they can sell, and what rights they carry. It’s the same share purchase agreement, but with instant updates, traceability, and far less admin.

Future equity. Investors receive a promise that turns into shares later, usually at a cap or discount. It’s the crowd-friendly version of a SAFE or convertible note. For early-stage founders, this works when valuation is still fluid but momentum is strong. Tokenization keeps removes trust from that process: all the conversion terms and triggers are coded in, so investors get equity automatically when the company is valuated.

Digital assets. Here, investors buy a tokenized payable, essentially a programmable loan. Smart contracts handle principal and interest automatically: they release payments, track balances, and enforce compliance rules without intermediaries. It’s still debt at its core, but smoother and cheaper to administer. Perfect for businesses with predictable cash flows or recurring income.

Debt. Tokenized debt makes lending far more flexible. Smart contracts handle payments and collateral automatically, so loans can adjust to revenue or milestones. Plus, tokenized assets can serve as collateral that fulfills automatically, letting banks or investors fund customers who previously wouldn’t qualify for a loan. For example, someone could tokenize an apartment and use only a fraction of its value as collateral for financing.

Other forms. Not every token needs to represent ownership or debt. Some founders issue NFTs as membership passes, preorders, or community access. It’s a softer form of alternative financing: you’re not selling equity or promising returns, but building loyalty and early awareness around your brand. When combined with an equity or debt raise, it can make investors feel like insiders.

How tokenization fits. Tokenization doesn’t change the deal, it changes the plumbing. Equity remains equity, a SAFE remains a SAFE, debt remains debt. What changes is the infrastructure: automated onboarding, identity checks, cap-table updates, and payout distribution.

That’s why many crowdfunding and STO platforms use tokenization even when they don’t advertise it. Tokenization is the invisible layer that powers alternative financing options and makes small-scale private investing possible.

Alternative financing runs on infrastructure. And we build it.

Launch your digital securities offering with Aetsoft’s STO Platform.