Blockchain applications in fintech

-

Remittances

-

Daily purchases

-

Securities trading

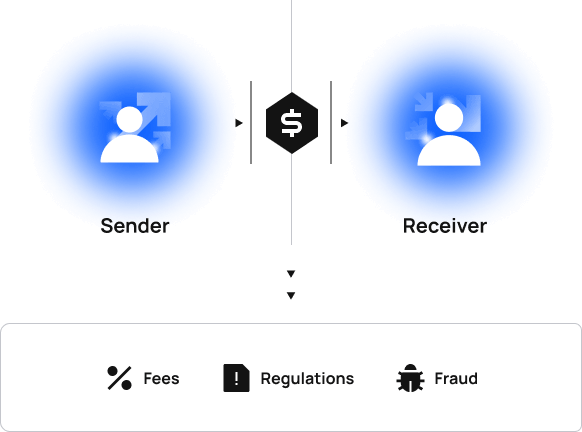

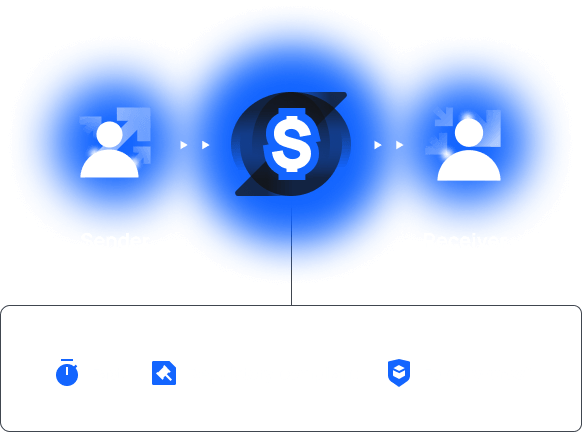

Use case 1. Fast remittances

Currently

Fees, regulations, and fraud risks harden remittances, particularly cross-border ones, and even result in fund theft during transactions.

With blockchain

Provide fast and tamper-proof remittance services for clients, with all transactions taking place on a decentralized, incorruptible blockchain network.

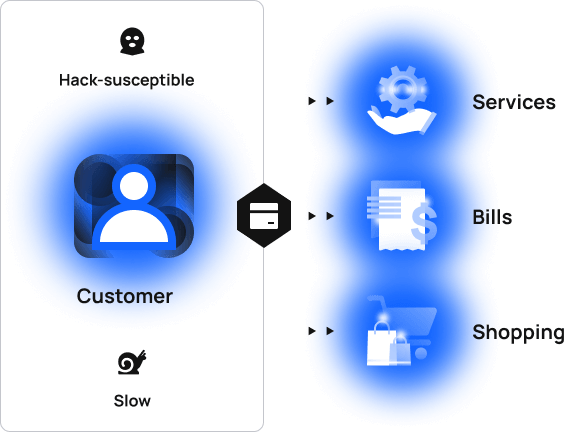

Use case 2. Daily purchases

Currently

Customers who make purchases daily with credit cards often deal with the provider’s network issues, bringing slow payment processing and even fraud to the table.

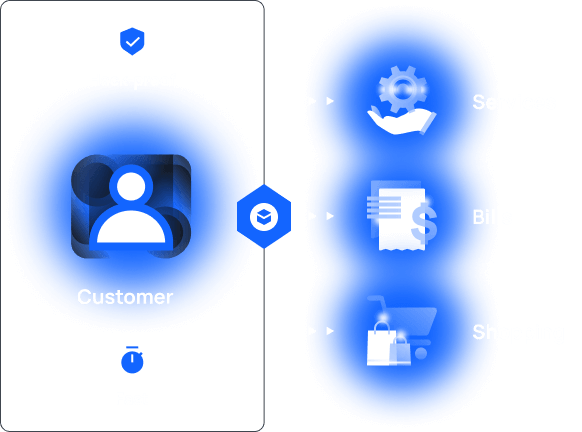

With blockchain

Allow customers to pay in blockchain-enabled assets guaranteeing high transaction speeds along with data security.

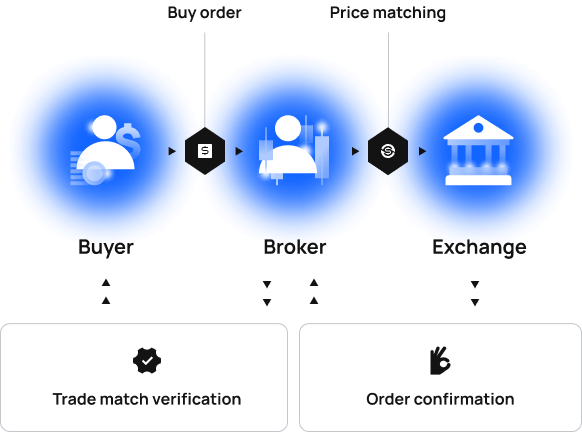

Use case 3. Automated securities trading

Currently

Traditional securities trading is a slow and sometimes unreliable process, where buyers should deal with brokers before the exchange, which adds unnecessary friction.

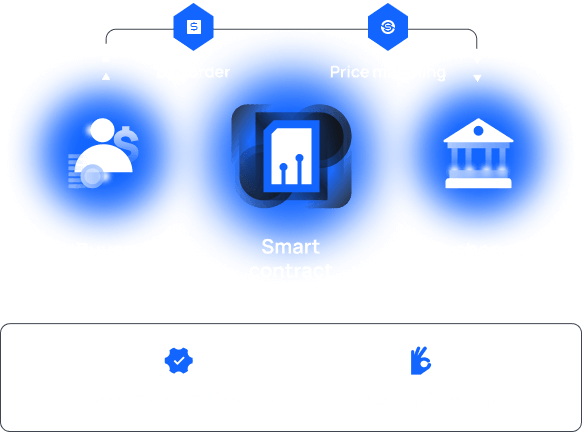

With blockchain

Handle all trading steps, from order to confirmation, automatically by delegating intermediary-dependent tasks to self-enforcing smart contracts.