Since the introduction of blockchain, it has been foreseeable how it can bring significant growth to various sectors, including finance. The demand for blockchain increased drastically as it had raised the market capitalization of cryptocurrencies and ICOs. The adoption of advanced blockchain solutions stimulated the demand for distributed ledgers as more secure financial tools.

The fintech blockchain market is expected to expand from USD 3.17 billion in 2023 to USD 21.67 billion by 2028 at a CAGR of 46.92% during the forecast period. The smart investment in cryptocurrencies and digital tokens adoption is foreseen to boost the market scale.

Blockchain in Fintech

Blockchain in fintech is a decentralized peer-to-peer (P2P) ledger that securely manages and stores transactions on publicly accessible computer networking. It introduced the whole financial industry with new huge possibilities by broadening several investment choices. With advanced decentralized solutions, the financial sector elevates its revenue generation potential, user experience, delivery output, security, accessibility, and ultimately work efficiency.

The whole interlinking process between the finance sector and blockchain revolves around the term known as Decentralized Finance (DeFi), a new financial paradigm that is based on distributed ledger technologies. Those technologies offer services such as lending, investing, and exchanging crypto tokens.

The fusion of blockchain with finance enables distributed transactions on blockchain networks. It makes the whole process more transparent and secure, helping businesses exchange their digital assets without any third-party interference. However, the question arises of how blockchain impacts the finance sector in terms of its use cases. Keep reading this article to get detailed information about the fintech blockchain.

Role of Blockchain in Fintech

Traditional financing mediums have been useful but not that impactful. There were instances where companies lagged behind due to long transaction times, high transaction costs, and lack of transparency and security. The integration of blockchain and finance has eliminated these prominent concerned zones. Let’s go through the major benefits this mix has already delivered.

Ease in Maximized Operational Costs

Blockchain in fintech reduces the whole transaction costs within the network. Based on the traditional system, every transaction includes all credit card networks, merchant payments, and other entities that charge fees for their services.

As blockchain works by decentralized finality principles, P2P transactions, and decentralized protocols, it eliminates the third-party intervention charges from banking operations. It improves the transaction time and reduces the gas fees for all stakeholders.

Decentralization over Limited Service Availability

Due to regulatory restrictions companies have to deal with, the usability of their applications is limited. There is also a lack of availability of required branch assistance and remote staff.

But blockchain has eliminated these concerns practically in all their entirety. Using blockchain’s decentralization, companies can easily operate without any restrictions. Decentralized applications, cryptocurrency, and smart contracts development allow clients to operate their conduct from any location across the globe.

Reduced Security Threats

Data security and customer privacy are among the major concerns associated with the finance industry. The adoption of blockchain in the financial sector has reduced cybersecurity threats and fraudulent activities due to its decentralized nature, strong encryption, and data immutability.

Strong Traceability over Lack of Transparency

The traditional financial system creates a lack of traceability and transparency for fintech companies. As earlier, the whole financial system was centralized and the involvement of multiple intermediaries interrupted verification and tracking records.

Blockchain technology utilizes a distributed and decentralized ledger that offers unmatched transparency and traceability in the network. Blockchain’s complex algorithms and protocols verify every transaction and keep them secure.

Lagged Performance

Traditionally, transactions take from several hours to several days due to manual processing and multiple intermediary interventions. Blockchain is designed to process transactions in a blink with advanced authorization and minimal settlement time. For both clients and companies, blockchain development offers quicker and more convenient financial solutions that process payments instantly.

Blockchain’s Benefits in the Financial Sector

- Backup assistance. Blockchain’s DeFi development distributes nodes across devices, which saves companies and individual users from issues like corruption, fraud, and DDoS attacks.

- Lower fees. Blockchain excludes the need for intermediaries thus reducing transaction costs. Still, if there are some costs involved with transactions (gas fees), they are much lower than traditional financial systems.

- Automated process. Blockchain in the finance sector automates service by executing a smart contact layer. It reduces the number of third parties and simplifies the whole process of financial operations.

- Quick settlements. Blockchain technology allows settling transactions faster than before by drastically lowering the whole settlement time. Those transactions that could take up to 3 business days in the past can now be completed in a couple of seconds.

- Maximum reach. Blockchain’s decentralized finance reduces the cost of service and makes cross-border payments more affordable. Fintech blockchain enables low entry costs that open the door to foreign possibilities.

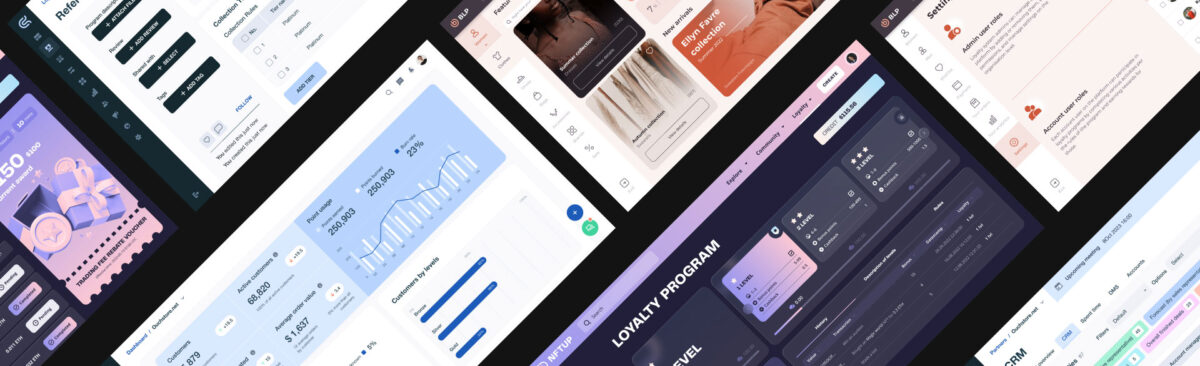

Blockchain Use Cases in Fintech

- Digital payments. Blockchain allows businesses and users to freely buy, sell, and transfer their digital assets with zero to minimal gas charges.

- Trading/exchange. Blockchain opens new possibilities with decentralized exchange as an ecosystem that utilizes smart contracts to facilitate and safeguard transactions without any third-party intervention.

- Asset management. Blockchain’s fintech solution allows banks, businesses, and other financial institutions to streamline assets and stakeholders to manage whole financial proceedings.

- Lending. Fintech’s blockchain solution makes lending & borrowing procedures smooth and accessible for all lenders and borrowers. Here, the loan is provided to borrowers using their digital assets as collateral.

- Digital identity management. Overriding the current financial verification process, which includes valid ID proofs, as blockchain follows its verification criteria ensuring the ultimate privacy and security of the network.

Bottom Line

A question that always arises is, “Is blockchain truly revamping the fintech industry?” Well, the answer is yes, and it’s true how blockchain in fintech potentially revolutionizes the existing payment modes, elevating security and overcoming persistent challenges. At present, some regulatory and interoperability issues are prominent in the ladder of fintech blockchain development, but soon, the technology will surpass them all.