Blockchain continues transforming business sectors to the form we haven’t used to see and imagine. This year promises to be big for blockchain, and today, we invite you to make sure of it, with six important blockchain trends to watch in the next twelve months.

Be sure to invest in blockchain, if you haven’t done it already!

Major Blockchain Trends to Watch in 2021

Banks are Preparing the New Revolution in Finance

The market of blockchain-based frameworks is getting torn apart by fierce competition, especially between public blockchains. More choice makes consumers more demanding, so the dominance belongs to the ones that offer new solutions, such as decentralized financial ecosystems and protocols interoperable with different blockchains.

One of the most persistent “stumbling blocks” that every blockchain developer encounters on its way is regulations. Currently, government-backed payment systems are mostly unwilling to welcome private ones like them, for obvious reasons. However, society reacts negatively to events such as Libra’s legal banning or a lawsuit against Telegram’s digital asset.

Perhaps, blockchain’s novelty and relative nascence are the main reasons why it loses the fight against governments. On the other hand, the users already adopted individual blockchain solutions, and some trust blockchain even more than banks.

There’s no way back for blockchain, and traditional banks realize that; for example, JP Morgan uses blockchain to automate margin payments, while Northern Trust tests blockchain-based fractional bonds.

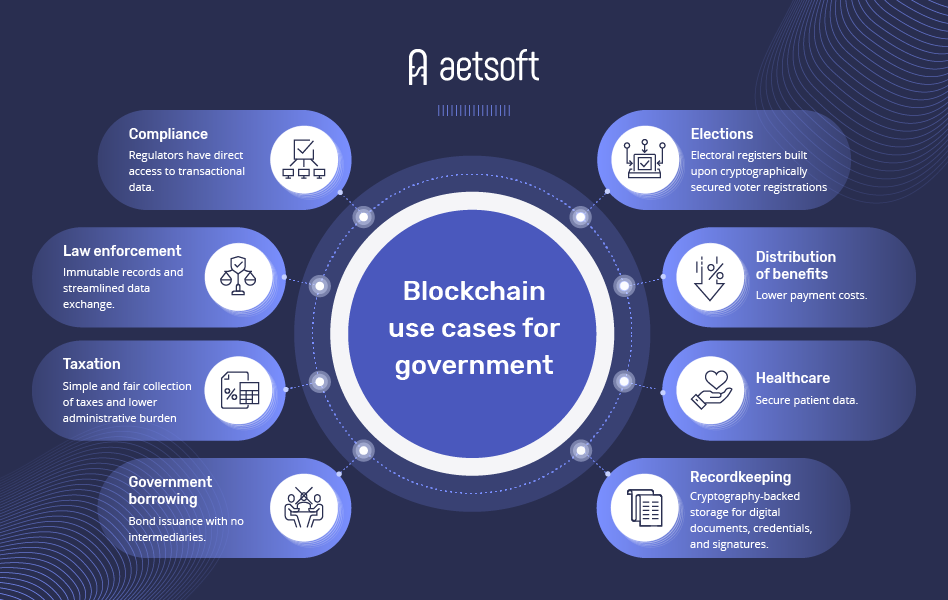

Blockchain to Join Government

Though blockchain’s role in government operations has been considered doubtful for a long time, small states were the first to give it a try. Then it came the turn of larger nations. For instance, Japan already admitted that blockchain could play a decisive role in the fight against COVID-19. Thailand is in works on a new storage system for legal documents. Also, the Columbian authorities already support initiatives related to blockchain payment systems.

All these cases tell us nothing about blockchain’s usage in government operations, except for Vietnam that uses a dedicated blockchain solution for digital transformation — akaChain, and South Korea that uses blockchain for registering driver’s licenses.

But China is, perhaps, the most vivid example; last year, the country issued its own blockchain-enabled digital asset. This move is likely to shake the global economy, yet the real effect is hard to evaluate for now.

Governments Answer with Stricter Regulations

Indeed, regulators will continue tightening the law, introducing even more limitations to the blockchain sector. And since the pandemic precipitated the digitalization of the economy, regulators closely monitor digital banking and blockchain. In the latter’s case, more realistic blockchain applications that promise real help for healthcare, supply chain, and other industries cause keen interest from businesses.

In the light of the developing fintech, more financial transactions occur outside traditional institutions, making those impossible to ignore from the regulatory viewpoint. At the same time, EU legislators are increasingly advocating for creating a global regulatory system for digital assets.

Asia Keeps Rising

China’s DCEP digital asset introduced last year made the country one of the most interesting blockchain hubs to watch. On the other hand, these are a series of blockchain projects in the supply chain intended to disrupt the industry.

Meanwhile, India demands more clarity in blockchain regulations. After the ban on crypto banking was reconsidered and eventually canceled, the digital assets industry has grown massively along with the movement to proof of stake.

Overall, blockchain’s stance in Asia during the last year was characterized by an accelerated transition to digital assets. The pandemic forced galleries and exhibitions to turn online, so digital became the obvious option.

Central Banks and Big Tech to Compete

Last year, the Central Bank Digital Currencies (CBDC) released a report that pointed out that 80% of the world’s central banks were already tied with digital assets somehow.

And again, China made, perhaps, the most significant progress in that direction. For example, last month, Suzhou’s city conducted a lottery during which it was giving away money to citizens through their digital wallets. Yet, the condition was that they must spend the cash given in a few weeks; otherwise, it disappeared.

Besides central banks, there are big companies that have their stake in digital finance. Some already consider offering an international digital asset. And here, they understand that not only the digital payments market is perspective, it also holds the tremendous potential for payments that support several digital asset markets at once (such as the Bitcoin one).

Decentralized Computing will be Gaining Momentum

Blockchain is more than just technology; rather, it’s a software design approach that implies connecting multiple computers in a single network where they must follow certain rules, a common code of conduct that tells them how to validate operations.

Blockchain may forever change the way internet servers and whole networks are arranged. Developers may set up servers without actually “setting up” them since all network nodes will have equal rights. Compared to the web, where servers must approve or disapprove HTTP protocol requests, on a blockchain, every single request must be sent to the whole network that will handle it through consensus.

This is a short list, yet it includes all the important trends that will be actively discussed during the year. We see that those are not limited by fintech only; rather, it encompasses governments, regulations, Big Tech, and various use cases across industries. Blockchain is an essential part of the world’s digitalization, a way to the whole new future, and 2021 will be a leap year to bring this future closer.