Read our new blog post to find out what role AI plays in crypto trading, what benefits crypto AI agents bring, and how to use AI for crypto trading in your particular niche.

The world of AI-powered trading is flourishing, and here’s the proof. According to a new report, the worldwide AI trading platform market was valued at $11.26 billion in 2024 and is forecast to reach nearly $70 billion by 2034, growing at a compound average growth rate of 20.04% in the analyzed period.

Such a growth is inevitable as AI-fueled crypto trading addresses the daunting challenges that traditional trading fails to overcome. One of them is the non-stop nature of crypto markets with extreme price swings. With AI, you can automate the whole process, monitoring and reacting instantly based on predefined rules. And the faster you jump on the technology bandwagon, the faster you’ll reap the fruits for your business.

Top Benefits of Using AI in Crypto Trading

The role of AI in crypto trading can’t be underestimated. Here are some of the key benefits to prove its value.

- Reduced emotional bias AI executes trades based strictly on logic and data, removing human emotions like overconfidence, impatience, fear, and greed that might lead to impulsive and irrational decisions.

- 24/7 operation. AI trading bots function around the clock, continuously monitoring the volatile crypto market and seizing the most winning opportunities. This ensures faster decision-making without human intervention.

- High-speed execution. Operating in milliseconds, AI-driven trading bots enable the rapid exploitation of short-lived opportunities like arbitrage, allowing for improved efficiency and performance.

- Increased risk management. AI-powered trading strategies usually include dynamic stop-loss orders and control leverage to better protect capital in volatile market conditions. AI agents can also spot suspicious trading activities, preventing market manipulation and potential fraud.

- Cost efficiency. By automating the entire trading process (from data analysis to trade execution) as well as working without fatigue and errors, AI trading bots significantly reduce operational costs.

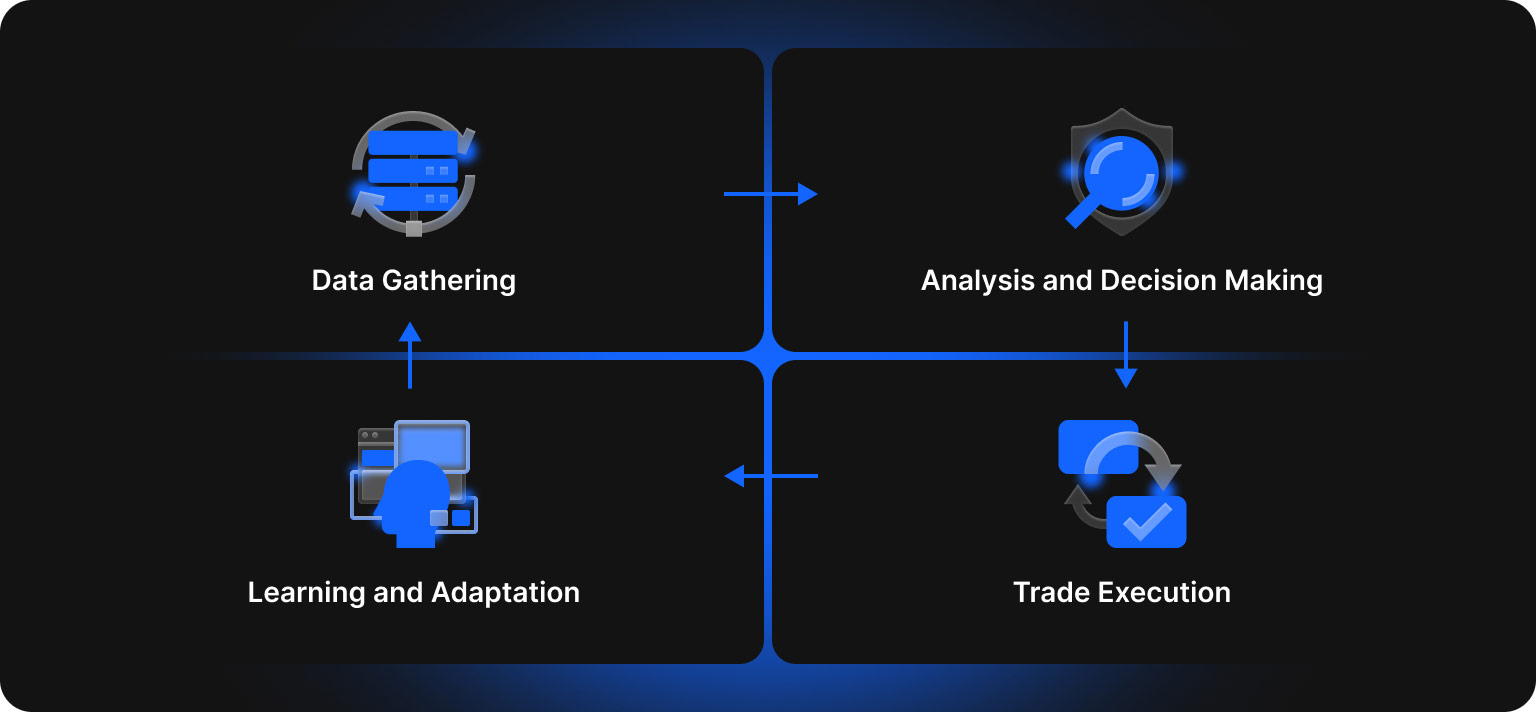

AI in Crypto Trading: How AI Agents Work

The previously mentioned business benefits are reached through powerful overarching AI systems that in turn consist of crypto AI agents. They represent autonomous smart programs operating on blockchain to automate complex trading strategies with minimal human intervention. Automated trading, portfolio management, smart contract management, and other tasks are performed through the following steps.

Data Collection

Trading bots gather huge volumes of data from both various sources:

- On-chain data is the publicly accessible and transparent information that is permanently recorded and stored on the blockchain network. This usually includes transaction details, token prices and transfers, liquidity pool changes, wallet dynamics, smart contract interactions, exchange flows, and network activities. The analysis of this data allows AI agents to understand blockchain activity, monitor network health, track asset movements, and develop analytics tools for decentralized finance (DeFi), NFTs, etc.

- Off-chain data comprises the information and activities that happen outside the blockchain network and are not recorded on the public ledger. This data is crucial to provide the context for trading decisions and includes mostly market data (pulled from centralized exchanges and other APIs), social media trends, news feeds, macroeconomic indicators, web traffic, forum sentiment, and developer activities (like GitHub commits).

Market Analytics

By leveraging advanced ML models like Long Short-Term Memory (LSTMs), AI agents process the collected data to build overarching market intelligence:

- Sentiment and narrative analysis. Underpinned by NLP, AI agents interpret the market’s mood from various sources to understand psychological drivers and predict sentiment-driven price moves.

- Pattern recognition. AI-driven trading bots are able to identify complex patterns like price cycles, trading signals, and market trends that are usually invisible for human traders.

- Risk assessment. To protect capital, optimize returns, and minimize potential losses, AI agents use risk management metrics like Value at Risk (VaR), Conditional Value at Risk (CVaR), drawdown analysis, sharpe / sorting / calmar ratio, position sizing, exposure and leverage management, as well as stop-loss and take-profit levels.

- Predictive modeling through ML models like regression and time series models is performed to forecast future price movements, market volatility, and trends based on historical and real-time data.

- Market microstructure analysis includes gauging parameters such as order book dynamics, bid-ask spreads, liquidity and depth, trade execution and market impact, price formation, market participants, microstructure noise, and time / frequency of trading.

Decision-Making And Execution

After the data is collected, processed, and analyzed, the decision-making stage is performed.

- Autonomous decisions. Based on the processed and analyzed data, trading bots define the optimal course of action for a particular task and execute the decision on the blockchain network. This might comprise defining entry and exit points for trades, executing arbitrage opportunities, rebalancing portfolios, routing trades across multiple decentralized exchanges (DEXs), etc.

- Feedback loop and continuous learning. After the trade is executed, trading bots continuously monitor the market to compare the trade’s outcome against its predictions. AI agents also learn from their previous actions to enhance performance over time, better adapting to changing market conditions and making more accurate decisions.

How to Use AI for Crypto Trading: Real-World Use Cases

Automated trading helps create complex trading strategies aimed at maximizing revenue, while ensuring robust risk management. Here’re some key use cases describing how you can capitalize on crypto AI agents.

- Dynamic portfolio management. AI trading bots continuously analyze real-time market data (including cryptocurrency prices, trading volumes, order book depth, and bid-ask spreads), historical information (price trends, technical indicators), and market volatility (social media, news sentiments, macroeconomic indicators, blockchain-specific data). Based on this information, they determine optimal allocations across multiple cryptocurrencies and rebalance portfolios, while adapting to changing market conditions, maximizing returns, and minimizing risks.

- Smart contract interaction. AI models perform a complex market analysis to generate trading signals off-chain, including buy, sell, and hold decisions. Then, by using a secure bridge called a decentralized oracle, AI systems communicate these signals to a smart contract deployed on a blockchain (through APIs / Web3 interfaces integration), check conditions such as available funds, and execute the trade) by interacting with decentralized exchanges (DEXs) or liquidity pools).

- Decentralized finance (DeFi) optimization. Underpinned by powerful ML mechanisms, crypto AI agents analyze on-chain data and market conditions in real time to automate complex tasks like yield farming, liquidity provision, lending, borrowing, and arbitrage execution. Such automation allows maximizing returns, minimizing risks, and enhancing efficiencies across the entire DeFi ecosystem.

- Automated arbitrage execution. AI-driven trading bots constantly monitor multiple exchanges (including real-time price data, order book depth, and transaction costs) to detect price discrepancies of the same asset. Once a profitable opportunity is detected, AI agents execute simultaneous buy and sell orders, while optimizing timing and order sizes, maximizing profit, and managing market risks.

- Fraud and anomaly detection is performed through a multi-layered approach that combines on-chain data analysis and advanced ML algorithms. The system monitors transaction volumes / location / frequency, user behavior, and market movements in real-time to identify and flag fraudulent patterns, previously unseen threats, and pump-and-dump schemes before they can cause damage. This might include suspicious wallet behavior, wash trading, sudden liquidity removal, etc.

Building AI-Based Crypto Trading System: Aetsoft’s Approach to Development

Underpinned by multi-year AI expertise and knowledge of cryptocurrency AI trading, we at Aetsoft prioritize the following model development principles.

High-Frequency Data Pipelines

To address the challenge of integrating on-chain and off-chain data into a unified AI feed, we engineer hybrid, microservices-based architectures for AI trading systems with the following architectural mechanisms:

- Data collection and orchestration. For low-latency, real-time streaming of market data from exchanges, we use WebSockets. For large-volume off-chain data that is too expensive to store on-chain, we use decentralized storage solutions like InterPlanetary File System (IPFS). Seamless distribution of data across various pipeline stages (ingestion, processing, loading) is ensured through tools like Apache Kafka and Apache Airflow.

- Data processing and unification. To notably improve data scalability, maintainability, and resilience, we break pipelines into modular, independent services set to perform specific tasks like data cleaning, normalization, and feature engineering. We also use in-memory data stores such as Redis for faster data processing and integration.

- Data integrity and resilience. To prevent errors, inconsistencies, or missing data points in pipelines, we employ data validation rules and quality checks at multiple stages. By implementing automated failover mechanisms and data replication, we ensure continuous system operation and minimized data loss in case of component failures. Finally, monitoring tools like Prometheus and Grafana help us continuously rack pipeline performance, latency, and error rates in real time.

Security And Auditing

Ensuring rock-solid system security is another principle at Aetsoft. For that to happen, we leverage a multi-layered, security-by-design approach that comprises:

- Model and data security. By enabling adversarial training, we make AI-fueled crypto trading systems resilient to adverbial attacks like data poisoning, evasion attacks, and model inversion. We also validate and sanitize data to prevent AI models’ corruptions and incorrect decisions.

- Infrastructure and system security is ensured through secure API keys, IP whitelisting, multi-factor authentication, the principle of least privilege, isolated hosting environments, multi-signature wallets, and robust data encryption (with protocols like HTTPS or WSS/TLS).

- Regular security audits. We perform frequent code reviews and penetration testing across AI models and the whole platform infrastructure. Automated anomaly detection mechanisms allow us to spot suspicious behaviors in network traffic and bot activities to trigger alerts. Besides, we leverage AI for static and dynamic analysis of smart contracts’ code to automatically detect vulnerabilities.

Strategy Validation

Before an AI model goes live and you commit real capital in the volatile cryptocurrency market, we evaluate its potential effectiveness and profitability through backtesting. Namely, we use historical market data and simulation of complex trading strategies to determine their hypothetical past performance.

- Out-of-sample testing presupposes leveraging historical data that was not used during the initial training or optimization stages. This way, we make sure the model can generalize to new market conditions, while preventing overfitting.

- Accounting for real-world costs. To avoid an overestimation of possible profits, we realistically simulate transaction fees, slippage, and liquidity constraints.

- Performance evaluation. Gauging the trade-off between risk and return is possible through specific parameters such as profitability metrics (win rate, profit factor, total profit/loss), risk metrics (maximum drawdown and Sharpe ratio), and prediction metrics (accessing the AI’s accuracy, precision, and F1-score).

- Paper trading comprises creating a live simulated environment with real-time market data to test the AI model. Thus, we validate the model adaptability to the current market microstructure and address latency issues.

- Final validation and deployment. With all the received imperial evidence at hand, we refine the model, for example by addressing its possible weaknesses, revealing worst-case scenarios, and eliminating emotional bias. Then, the model goes live with controlled risk, and we continuously monitor the model to prevent “drift” as the market dynamics change.

Partnering with Aetsoft to Introduce AI in Crypto Trading

AI is gaining a stronger foothold in crypto trading, and you just can ignore it. Minimized emotional bias, around-the-clock operation, high-speed execution, rock-solid risk management, improved efficiencies, slashed costs, the role of AI in crypto trading is immense, considering the volatility of markets.

Experts in all things AI, Aetsoft is ready to help you get a competitive edge by developing a custom AI trading system or an advanced asset management solution. Drop us a line, and we’ll get back to discuss the details of your project.