A Security Token Offering (STO) sells regulated securities recorded on a blockchain. Unlike regular crypto, it’s backed by real assets like equity, debt, or real estate.

Here’s a quick example. A luxury resort was tokenized under a Reg D offering. Investors received digital securities that represent equity in the resort’s company. Those tokens later traded on a licensed alternative trading system. All happened with the same rules and protections that apply to off-chain securities.

Disclaimer: The Content is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial or other advice. Nothing contained on our Site constitutes а solicitation, recommendation, endorsement, or offer by Aetsoft or any third party service provider to buy or sell any securities, tokens or other financial instruments.

There are risks associated with investing in securities and tokens. Loss of principal is possible. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of this information before making any decisions based on such information or other content. ln exchange for using the site, you agree not to hold Aetsoft liable for any possible claim for damages arising from any decision you make based on information or other Content made available to you through the site.

STO vs IPO vs ICO: crypto or traditional finance?

ICO (Initial Coin Offering). A project sells a utility crypto token. These are usually unregistered, often speculative, and almost never a legal claim on the issuer’s profits or assets.

Utility tokens work well for things like loyalty programs, in-app credits, or gated access to a network.

But for actual fundraising, they’re weak: who wants to invest in an asset backed by vibes?

IPO (Initial Public Offering). A company sells registered shares to the public and lists them on a national exchange. You get maximum investor reach, but also heavy disclosure, regulatory review, and a long lead time.

Everything is off-chain: shares are recorded in central depositories, held by custodians, and traded through broker-dealers. The system is proven but slow to change.

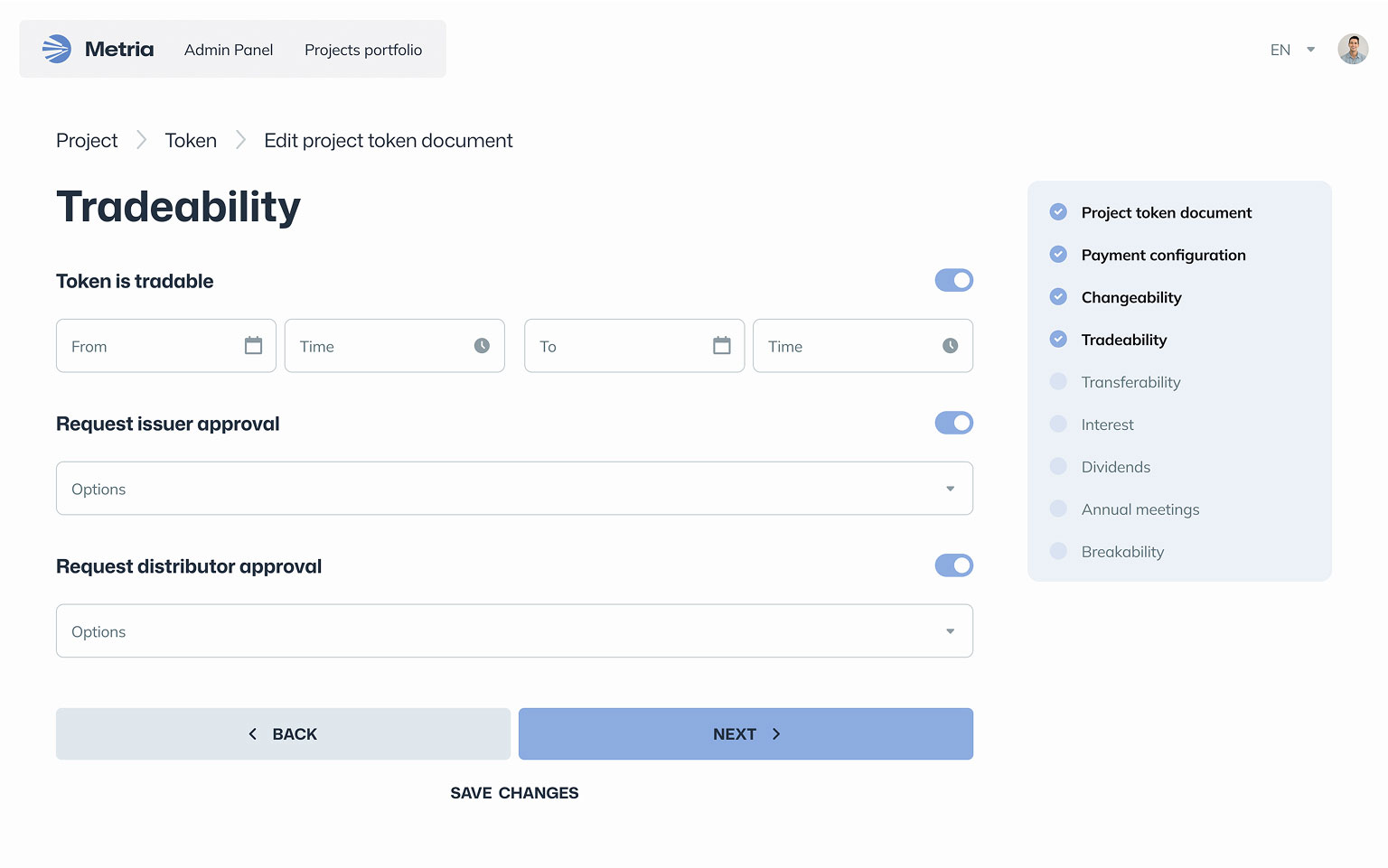

STO (Security Token Offering). Security tokens bridge the two worlds. A company or asset issuer sells regulated securities in token form: equity, debt, fund interests, or really anything else.

All the regulations still apply. The offering follows a lawful route: either a full registration or an exemption (like Reg D, Reg S, Reg A+). Buyers go through KYC/AML, just as in off-chain investment.

The key thing about tokens is all the rules are built into the token. So trades happen automatically via smart contracts. But they only happen with eligible, whitelisted investors.

IPO (Initial Public Offering). A company sells registered shares to the public and lists them on a national exchange. You have heavy disclosure, long lead time, and very wide distribution. Same goes for any financial assets: they are issued off-chain, held by a qualified custodians, proof of ownership and

STO (Security Token Offering). This option combines the best from both worlds. A company or asset issuer sells regulated financial securities in token form. That security can be equity, debt, or fund interests. Buyers go through KYC/AML. Offering rests on a lawful path: public registration or an exemption. Transfers follow rules. Secondary trading happens on licensed venues, not in the wild.

STO+IPO. Worth noting: STOs aren’t mutually exclusive with traditional raises. You can run them in parallel. You can, for example, list a portion of equity on a stock exchange while tokenizing another class of shares for a targeted investor group. Or you can wrap off-chain assets into compliant tokens for on-chain secondary trading.

Benefits of STO. Why do institutions bet on tokenization?

Token Offering is all about smart contracts.

Traditional private deals run on PDFs, email threads, and manual checks. Every change means someone updates a spreadsheet and hopes it’s the right version.

With STO smart contracts, all of that is built into the token itself. The transaction happens automatically, but only when conditions are met. Here’s what it brings to the private market.

Smaller tickets, cross border reach

Traditional admin overhead pushes you to chase a handful of large checks. But with STO, you can accept smaller commitments from qualified investors in multiple regions without drowning the back office.

That doesn’t mean anyone can buy equity. It means eligible buyers with clean KYC from Warsaw, Dubai, or Singapore can join the same raise, subject to the right channel and exemption.

There’s no technical limit to the size of a token, only legal boundaries. But we’ll talk about that later.

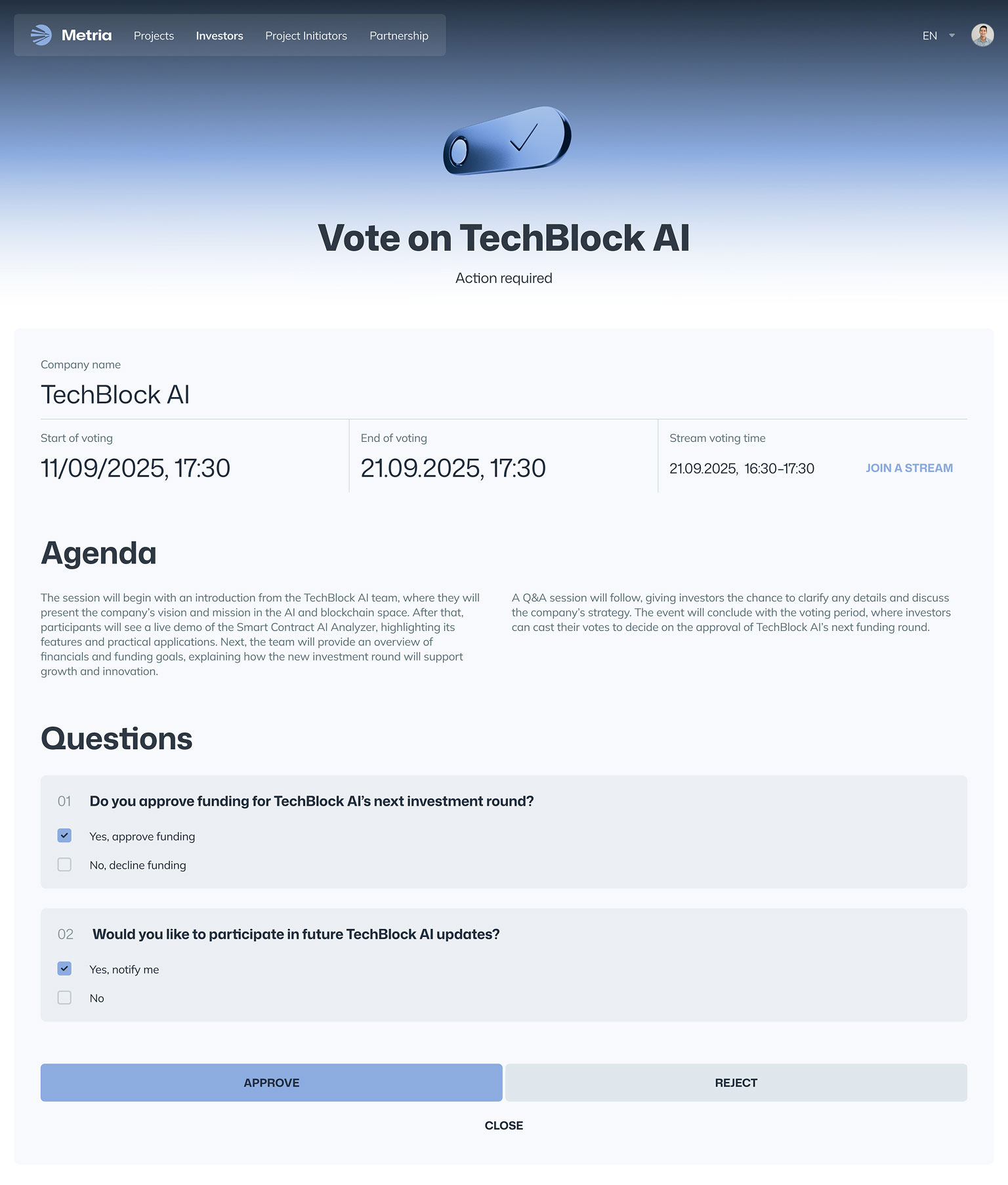

Corporate actions without paper cuts

With STO you you automate and enforce repeatable actions: dividends, coupons, redemptions, and votes. You map the economic logic once, then you run it as long as you want.

You have fewer stray payments. Fewer reconciliation emails. Fewer disputes about record date versus pay date. And yes, your auditor sees a tidy trail in one system, not a dozen of spreadsheets.

A cap table that answers itself

The chain gives you a living register: who owns what, when they got it, and what restrictions remain. That reduces legal risk, but it also speeds decisions. Need consent from 60% of Series B? You can calculate, message, and record outcomes in one place. There’s no question about which spreadsheet has the truth.

But there’s a softer benefit too: investor confidence. When holders know the ledger isn’t a suggestion, they can relax. Calm investors are long investors.

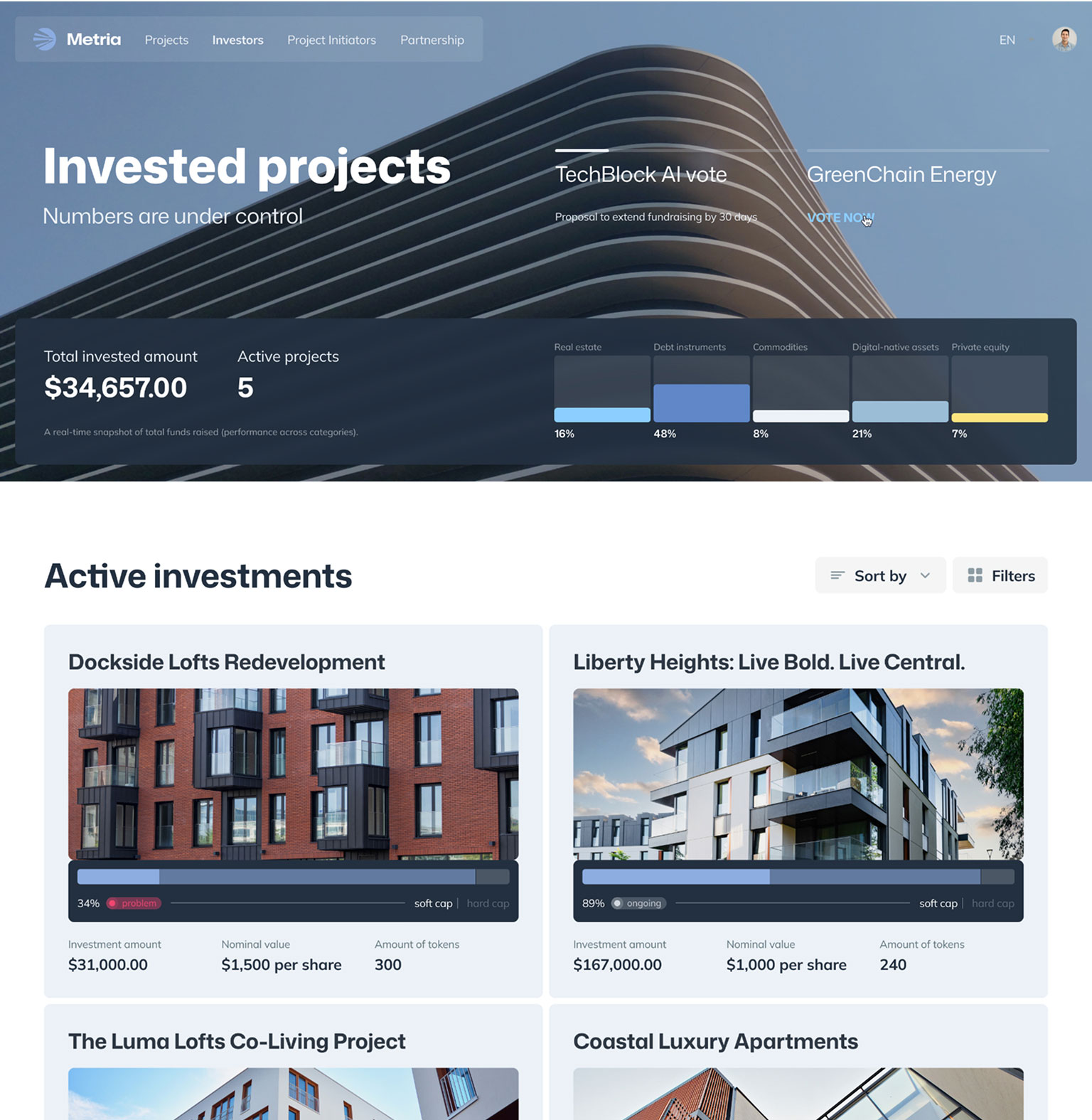

Much lower coordination costs

A tokenization platform keeps all coordination in one place. The investor signs, clears KYC/AML, funds, and receives the exact units they’re allowed to hold. All within one system. The result is boring in the best way: you get shorter cycles, cleaner closes, fewer places for human error to hide.

Think of a €25m real estate SPV. You have one hundred investors across three regions, mixed ticket sizes, two share classes. Is it possible to do with traditional finance? Yes, but with a major tangle because you have to manually check each investor. With STO, everything is automatic. All the legal rules live in the token.

Cleaner exits and creative structures

You can design structures that would be painful off-chain. Because rights are explicit and tokens are programmable, you now have more options.

Think of tranches with different waterfalls. Redemption windows. Earn-outs that vest on milestones and show up in wallets the moment they vest. You’re making classic structures less brittle, and thus you have more creative options.

Better data, smarter follow-ons

An STO platform is part CRM, part compliance log. And it’s always current.

Wallets and whitelists give you a clear picture of your investor base. Who tops up. Who flips after lockup. Who never reads notices.

That turns your next raise into a message to the right people, not a blast to everyone. As a bonus, distributions and updates that arrive on time build a reputation you can’t fake. The next round closes faster because the last round ran clean.

STO still has its limits

We believe STO is a better tool for finance. That said, it’s not a magic bullet. You still have to pay lawyers, auditors, venue fees, and tech. So here’s what you should know.

The law still runs the show

A security token is still a security. So you have to follow the rules for who can buy your tokens .Offerings sit under the same rules as paper shares or notes. You have to follow KYC/AML, sanctions checks, holding periods, or resale limits.

You have to pick an offering path: public registration or an exemption (e.g., in the U.S., Reg D 506(c), Reg S, Reg A+, or Reg CF). In the EU, you’re under the Prospectus Regulation/MiFID II family, plus specific guidance for DLT market infrastructures.

How do you handle this? Pick your exemptions early, map investors to those paths, and encode the rules in the token and the venue. Maintain a proper register and appoint someone to wear the transfer agent hat. Tokens don’t replace counsel; they enforce counsel’s plan.

Need legal help? We have a global network of legal partners. Find out more about blockchain consulting.

Secondary trading liquidity is still limited

In theory, STO is perfect for secondary trading. In practice, the technology is new and current liquidity is still growing.

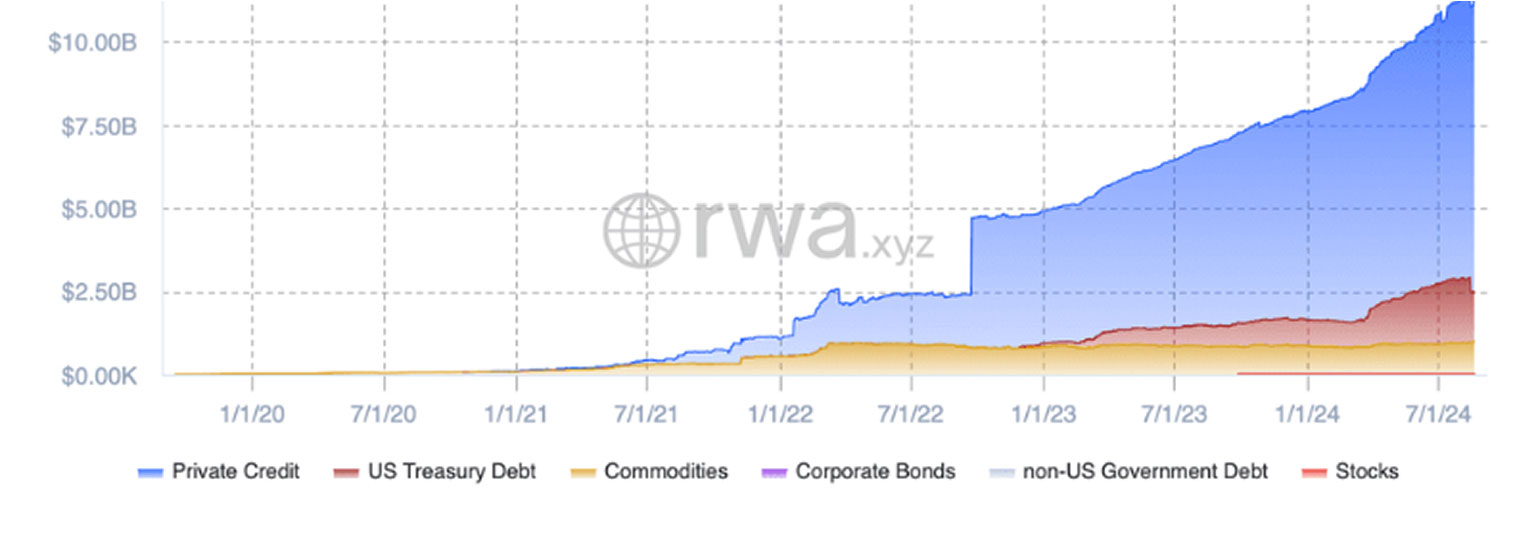

The good news is that it’s growing insanely fast:

Source: rwa.xyz

Deloitte estimates $4 trillion tokenized by 2035. And that’s only in real estate. The market is young now, but it won’t stay young for long.

How to handle this? For now, treat secondary trading as optionality, not a promise. Still, nothing stops you from building scheduled liquidity events: quarterly windows, buybacks, tender offers, or market-maker arrangements within the rules.

You can’t put the entire universe on-chain

Tokens still touch the real world. And the real world runs off-chain.

Property titles live in SPV registers. Cash sits in bank accounts. Assets are buildings, turbines, servers. If the sponsor mismanages the property, the token can’t mow the lawn.

Oracles, valuations, taxes, and sanctions checks all rely on external systems. If there’s a dispute, you’re back to the operating agreement, the indenture, and a judge.

Tokenization helps you drastically reduce risk, but it’s never going to be 0%.

Still, if you invest in a developing market, would you prefer a smart contract with independent oracles or would you rely only on a local court that you can’t access?

How to handle this? Plan for stress: insolvency, clawbacks, court-ordered freezes are all possible. So be smart about your smart contracts.

UX, custody, and vendor choices can bite

Institutional buyers want qualified custodians, individuals want “don’t make me learn seed phrases,” and venues need wallet types they can supervise. Now add the Travel Rule, sanctions screening, estate transfers, lost-key recovery, and multi-venue whitelists that must stay in sync.

One missed edge case, and a legitimate transfer bounces or, worse, slips through. Finally, your initial tech stack can become a cage if portability isn’t designed from day one.

So choose your tokenization platform, token standard, and venue integrations wisely. Or let us help you choose.

Which assets work best for tokenization?

The STO market is still young, but some assets are perfect for tokenizations. Here they are:

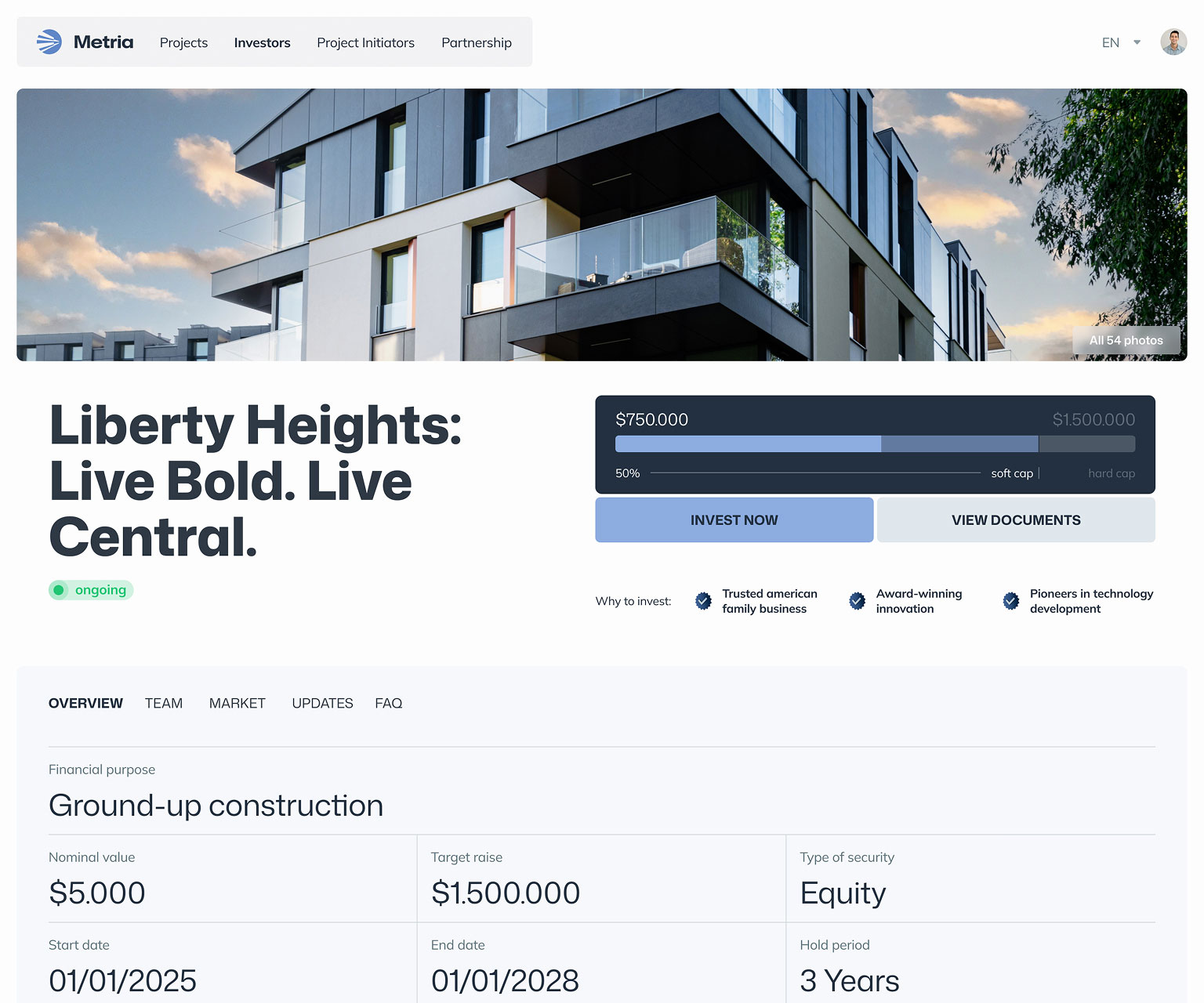

Real estate tokenization. Without STO, cross‑border onboarding crawls; you pass PPMs around, chase wires, and patch an Excel cap table. Resales stall on ROFR letters and wet signatures.

With STO, an SPV issues smaller tokens, investors clear KYC once, and whitelists keep regional rules straight. Distributions land in wallets on a timetable and lockups are enforced by code.

Private debt tokenization. Without STO, coupons go through SWIFT files, covenant checks arrive days late, and each assignment needs a fresh set of docs.

With STO, the note is tokenized; coupon dates, caps, and transfer limits are baked in; covenant status is logged and alerted; assignments settle by moving the token to an eligible wallet.

Fund tokenization. Without STO, capital calls travel by email, IBANs get mistyped, and an LP transfer can take weeks.

With STO, LP units are tokenized; calls post as signed notices with due dates; commitments fund via fiat (and, if policy allows, stablecoins). Qualified LPs can rebalance on controlled secondary without starting from zero.

RWA tokenization (especially high‑value, low‑velocity like art or cars). Without STO, fractional ownership leans on bespoke trusts and back‑channel brokers. Price discovery is opaque.

With STO, you wrap the asset in an SPV, issue regulated equity or notes, publish appraisal or NAV snapshots, and schedule venue auctions that make trades transparent and permissioned.

Receivables and royalty streams. Without STO, slicing cash flows breeds reconciliation disputes and late payouts.

With STO, each pool or series mints standardized note tokens; the waterfall is programmable and time‑stamped, so holders see what arrived, when, and from which source.

Special situations (single‑asset spinouts, carve‑outs). Without STO, repapering every holder slows the deal and registers drift.

With STO, you migrate into a fresh SPV, exchange legacy units for tokens, rerun KYC, and open rule‑based secondary after a defined lockup.

Thinking about your STO?

The most important part of tokenizing a security isn’t writing the smart contract or spinning up a private network. It’s getting the legal structure right. If you miss that, you risk a failure before you’ve even launched.

That’s why it pays to work with a team that’s done it before. We partner with legal and business experts in every major market, so your tokenization is structured correctly from day one.

We also provide licensing umbrellas, so you can enter a new market in weeks. Reach out for details.