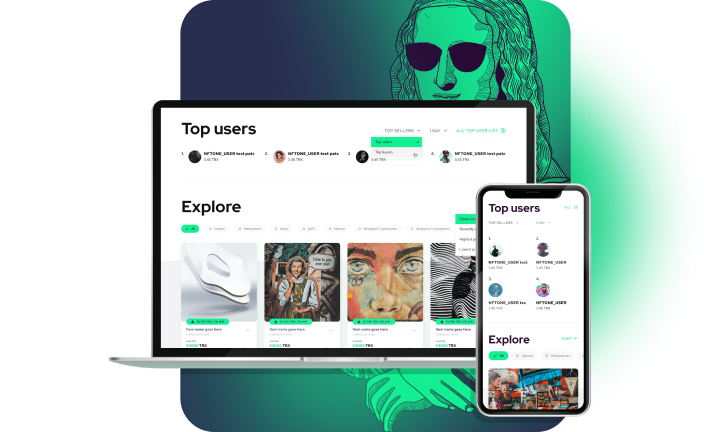

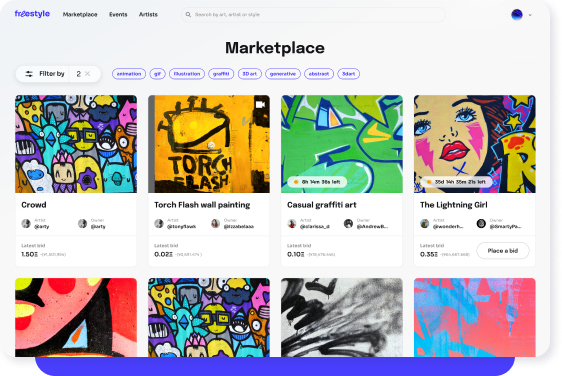

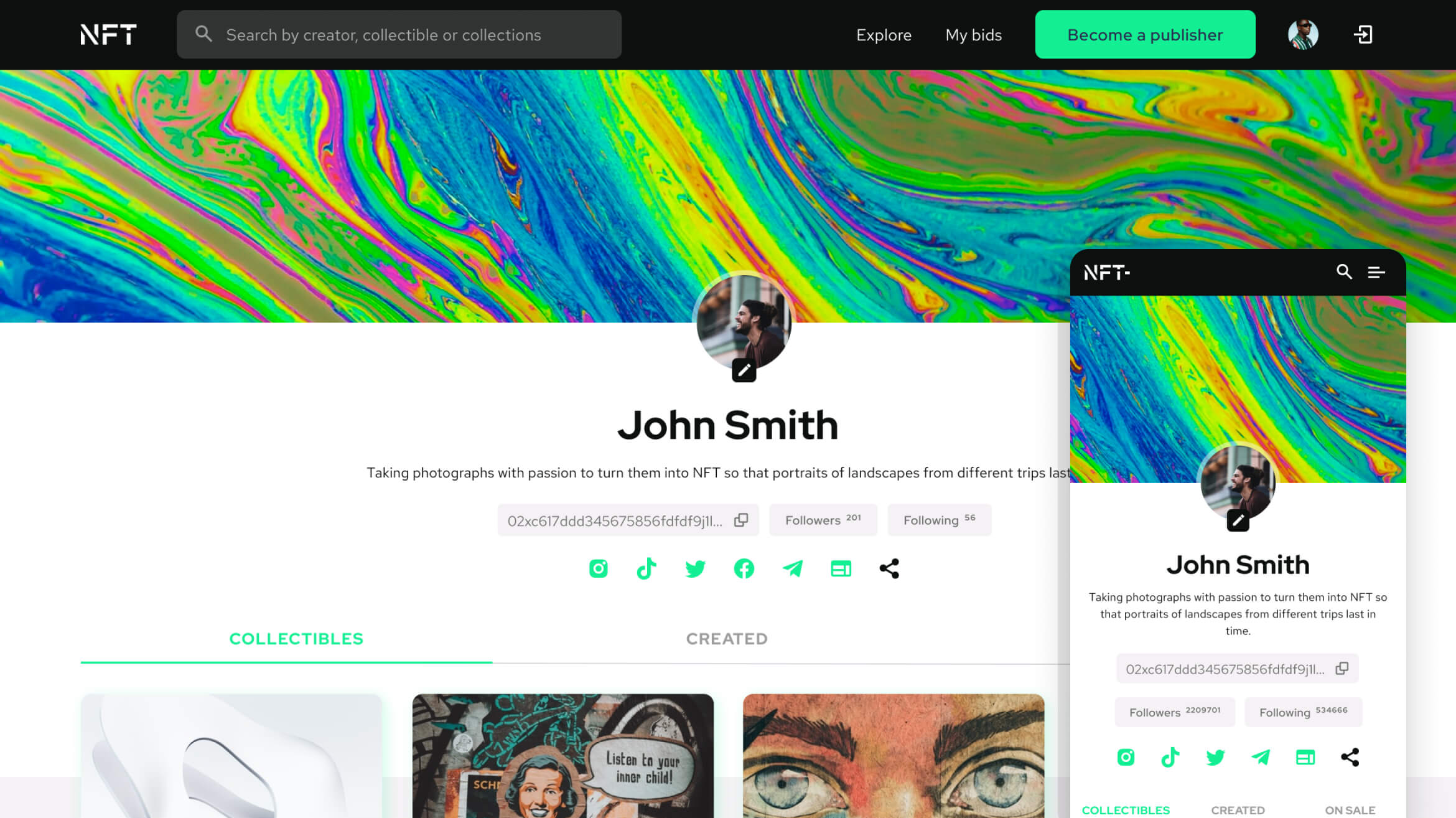

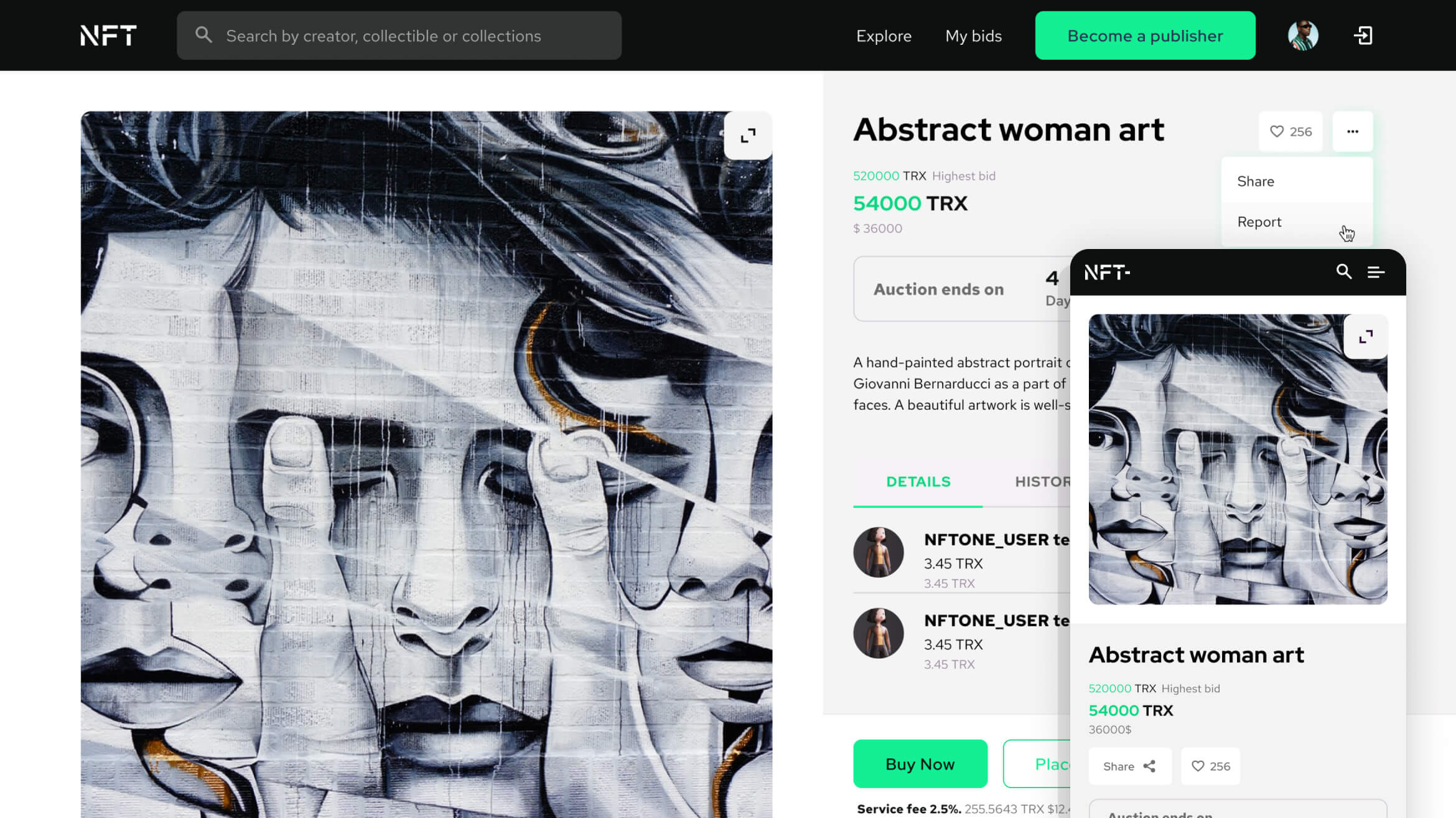

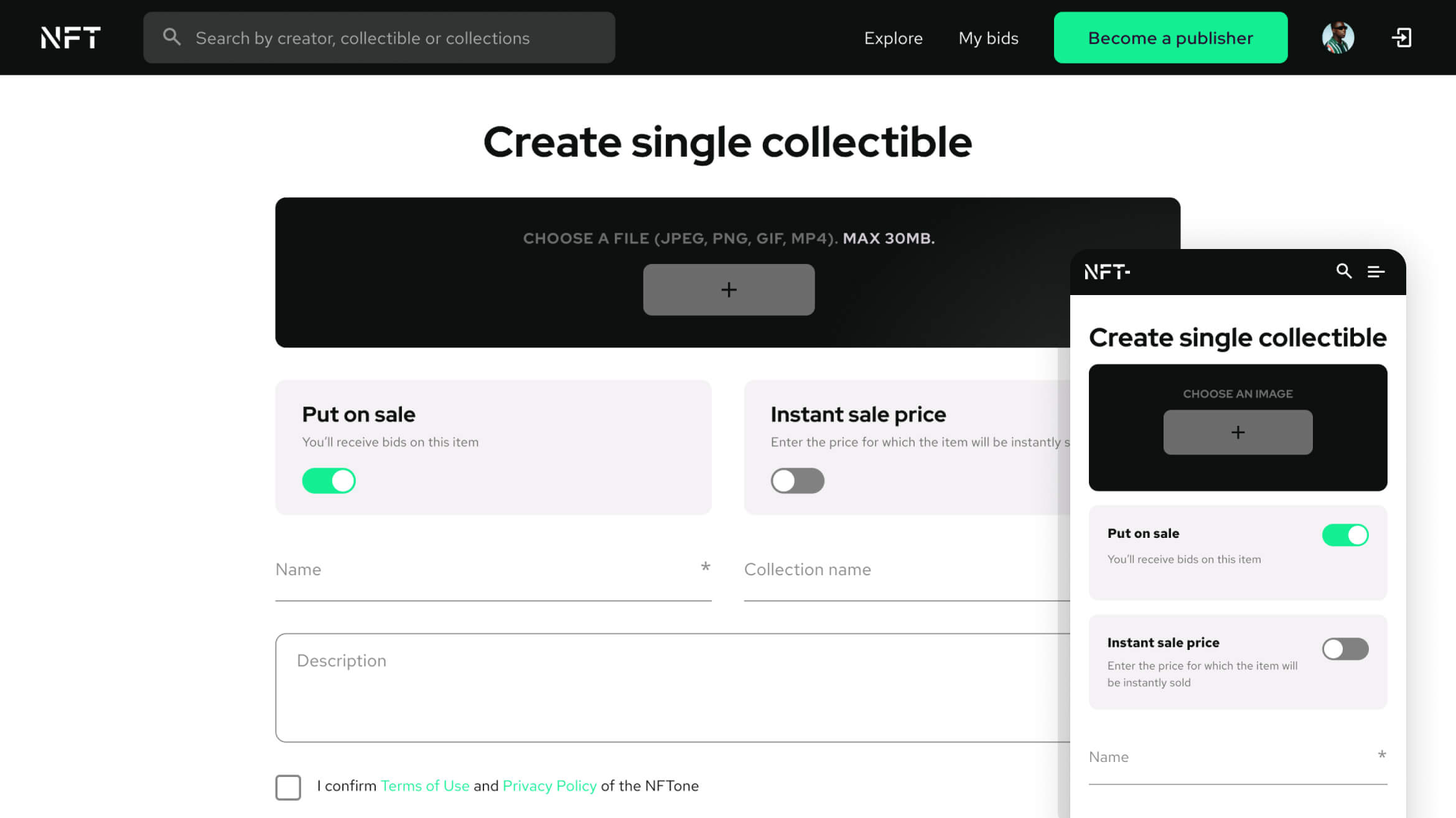

White-label NFT Marketplace

A ready blockchain solution where artists, musicians, painters, and other creators can trade works as NFTs.

Learn more

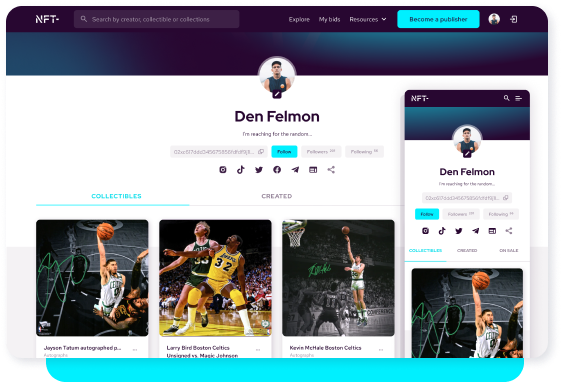

NFT for sports

A market where sports amateurs and fans can trade cards, iconic moments, and other exclusive content as NFTs.

Learn more

NFT Loyalty Program

A solution for creating custom NFT-based loyalty programs to drive customers’ engagement and boost their loyalty.

Learn more

White-label STO Platform

A dedicated marketplace for project initiators and investors where any digital and(or) physical assets can be issued in fractions as digital tokens, to gain early investor support.

Learn more

Crowdfunding Platform

A decentralized solution that brings together verified fundraisers and investors in a single network where investment decisions are made through majority consensus.

Learn more

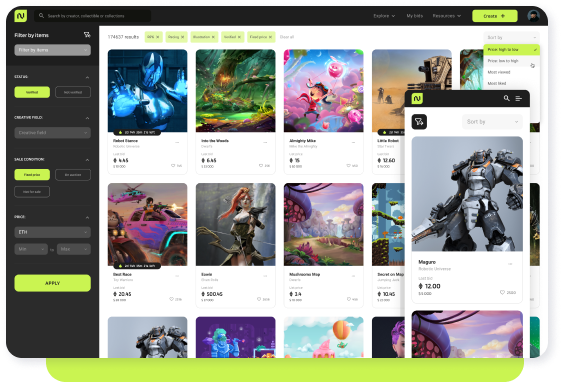

NFT for gamers

An NFT Marketplace for trading game collectibles through a blockchain-powered auction-based system.

Learn more

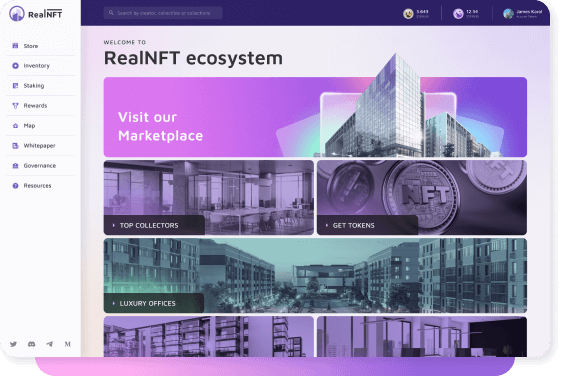

NFT for real estate

A digital marketplace for physical and (or) virtual real estate where users can trade and fractionally own property and stake their assets as NFTs.

Learn more

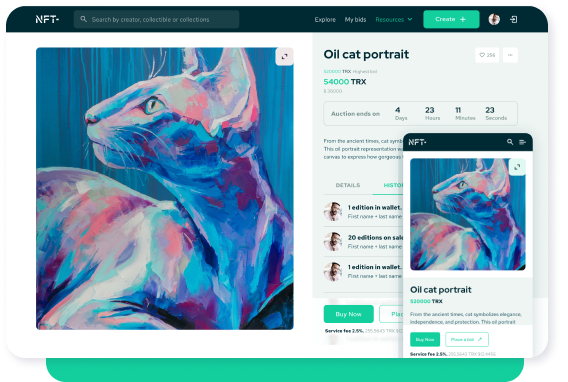

NFT for art galleries

An NFT trading platform where art creators can tokenize their artworks by trading them as NFTs.

Learn more

Digital Health Passport

A blockchain-based platform that keeps a record of disease tests in a single database.

Learn more

OLWay

A blockchain IoT platform for tracking logistics supply chains from origination to distribution.

Learn more

Look.ai

An AI-powered Shopify plugin for finding apparel based on clothing items on look images.

Learn more

EventCMS

A blockchain solution for conducting and managing live events and online ticket sales.

Learn more