Construction companies

Streamline construction management thanks to remote monitoring of project deadlines, real-time labor management, smart accounting, and other groundbreaking solutions.

Our product portfolio speaks for itself;

a White-label NFT solution for trading NFTs, the world’s first Digital Health Passport protecting firms and whole countries from COVID-19, and more!

We combine the profound tech expertise and strong R&D practices to deliver top-notch blockchain and business automation services and solutions to the global market.

We work with the aspiring startups and Fortune 500 companies, designing and developing highly-demanded products in the NFT, Healthcare, Logistics, and other essential domains.

Top-notch blockchain frameworks and technologies — everything we’ve learned developing custom solutions across multiple blockchains and protocols is at your disposal.

We are a custom development firm delivering innovative enterprise solutions. Need more info? We have a more detailed introduction for you.

Whether you need to streamline construction, property management, rental agreements, or other processes, we are ready to answer your business needs with cutting-edge solutions that bring process automation, real-time management and monitoring, and other innovative features.

Enhance your day-to-day workflows and improve their accuracy by integrating real-time inventory monitoring, remote equipment management, and real-time document management into your enterprise CRM.

Make it easier to manage mission-critical rental property management processes with smart accounting, automated tenant alerts and rental collection reminders, scheduled preventive checks, self-updated online ads, and other process automation features.

Launch your own real estate CRM with our company! We will help you simplify daily tasks for agents, such as lead generation, account management, and customer communication, with automated reporting, alerts, and virtual assistants.

Provide real estate agents and buyers with up-to-date information about relevant property listings, price dynamics, and property availability through a customized MLS platform that automatically gathers and updates all the multiple listings’ information.

Enhance the efficiency of your real estate enterprise workflows thanks to the software solution that unifies operational data in one place and enables real-time monitoring of operations end-to-end, from construction to selling.

Build a real estate portal that brings together brokers, agents, property buyers, renters, and owners in a single information hub with self-updated property listing data and online deals. Request real estate software development today!

Maximize property inspection capabilities with a solution that improves the entire process with scheduled condition checks, automated maintenance, and alerts.

Use real-time data analytics solutions that gather information from multiple sources, to make informed decisions in property management, maintenance, finances, marketing, and other fields.

Streamline construction management thanks to remote monitoring of project deadlines, real-time labor management, smart accounting, and other groundbreaking solutions.

Make property management more efficient with a centralized property marketplace where clients can explore virtual replicas of real-life property and make deals.

Share your real estate project idea with us, and we will come up with the right solution, be it CRM, ERP, MLS, or another, to ‘shake up’ the industry!

Get yourself a deal with real-time analytics of competitors’ prices and automated renting with a custom rental CRM.

Empower your project search and profit forecasts with real-time analytics tools aggregating data in dashboards.

Streamline construction management thanks to remote monitoring of project deadlines, real-time labor management, smart accounting, and other groundbreaking solutions.

Make property management more efficient with a centralized property marketplace where clients can explore virtual replicas of real-life property and make deals.

Share your real estate project idea with us, and we will come up with the right solution, be it CRM, ERP, MLS, or another, to ‘shake up’ the industry!

Get yourself a deal with real-time analytics of competitors’ prices and automated renting with a custom rental CRM.

Empower your project search and profit forecasts with real-time analytics tools aggregating data in dashboards.

Metaverse Rooms is a virtual infrastructure that includes over 3,000 apartments of different types — standard, luxury, and penthouses — and a variety of communal areas spread across three similar towers. Users can buy and rent apartments as NFTs, mint their own assets of various sizes and styles to customize their apartments, and decide how to construct, divide, and furnish those. Plus, the solution provides a marketplace of virtual real estate assets.

Metaverse Staking is a virtual real estate marketplace integrated with Metaverse Rooms, an infrastructure comprising over 3,000 customizable virtual apartments and communal areas. Players can stake their apartments as NFTs to trade those and earn staking rewards, mint, sell, or purchase a variety of in-game assets, such as wall panels, decorations, furniture, and more, all via a single marketplace solution.

Our solution allows for the tokenization of real estate by presenting assets in the form of tokens. It allows stakeholders to track their investments on the go and make new property deals more cost-efficiently using smart contracts, to remove intermediaries (brokers and banks) and hence exclude fees.

The client looked to innovate their real estate trading operations by coupling them with crowdfunding features. We provided them with a full-featured real estate trading platform for growth-focused investors. There, investors can support construction projects through crowdfunding, track project progress, and earn passive income from dividend payouts.

A group of UK-based real estate investment companies was looking for ways of making portfolio management more intuitive for real estate investors. With that task in mind, we provided them with Fractional Ownership Solution that allows investing and managing portfolios from one place and tracking the acquired, improved, and operated property in real-time. Also, the solution helps investors cut expenses thanks to flexible investment minimums calculated based on the available budget.

Metaverse digital real estate grants rich opportunities for virtual property trading. Mindful of that, the client wanted to add in-game property trading features to their virtual real estate metaverse game. We built and integrated a marketplace for real estate in the metaverse into the game, where users can build and trade land and property or earn it as rewards for completing in-game activities and (or) participating in in-game events.

Aetsoft

Tell us about your real estate project, and we’ll get back to you with a free consultation in one business day. Our real estate software development company is at your service!

Get expert adviceOur real estate software development company creates DLT-based solutions for virtual and physical real estate. Discover the entirely new opportunities of property trading with a virtual real estate platform coupled with NFT real estate minting features. Or, enhance your broker operations by creating a real estate tokenization platform — many things become possible with our blockchain real estate development services!

Provide a universal marketplace for constructors and property purchasers where they can make secure property deals via smart contracts and pay with tokens and (or) crypto.

Build a private investment platform for curated real estate investment deals where investors can support property construction through crowdfunding and earn passive income, with stable cash flows from dividend payouts.

Convert your physical assets (property, patents, land titles, etc.) into tokens to trade them seamlessly across online marketplaces like any digital asset.

Make shared ownership more affordable to investors with a blockchain-based platform that allows them to pool resources in order to buy a share of a property if they can’t buy it independently.

Run a DIY investment management platform where investors can track their performance in real-time and maximize returns with low fees and flexible investment minimums.

Streamline background checks by optimizing their costs and increasing security with blockchain-based digital identities of tenants and investors who pass KYC & AML checks.

Build a metaverse real estate investment platform where users can purchase, trade, and exchange land and property for other assets and rewards, customize, and monetize their property, or earn it as rewards in various in-game activities.

Let clients explore real estate properties (houses, apartments, flats, offices, etc.) before purchasing or renting them and (or) help constructors evaluate the impact of their decisions at each stage of the construction process with near-real simulated environments, or digital twins.

Give users an entirely new property purchasing experience with an NFT marketplace where they can buy and trade property in a couple of clicks as virtual real estate NFT.

Enhance your virtual environment (a video game or virtual venue) with property trading features by integrating a property marketplace, including digital wallets and crypto exchange, into it.

Easily integrate a third-party API payments infrastructure into your virtual property marketplace to automate property purchases and unlock new revenue drivers. You can also add the support of crypto wallets to ensure secure asset storage, compliant insurance, and instant purchases.

Integrate a custom blockchain KYC module into your virtual real estate platform to stay confident in customer identity through identity and data verification, and fraud detection.

Property purchasing

Identity check

Real-time accounting

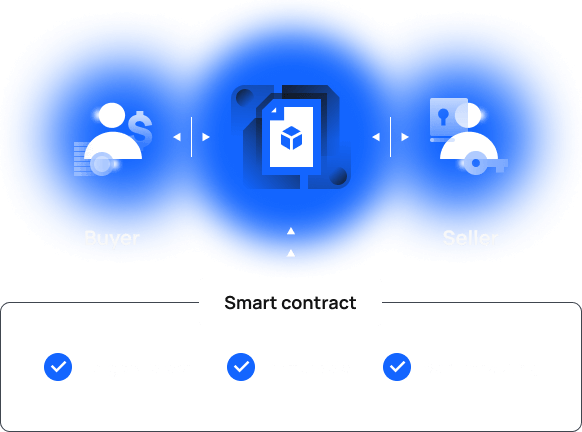

Property deals involve the whole army of lawyers, brokers, and insurance providers, each requiring a fee; otherwise, you won’t get a land title, and the deal will fail.

Blockchain-based smart contracts replace third parties, standing between property buyers and sellers, through autonomy and cryptography; more to it — they don’t require exorbitant fees!

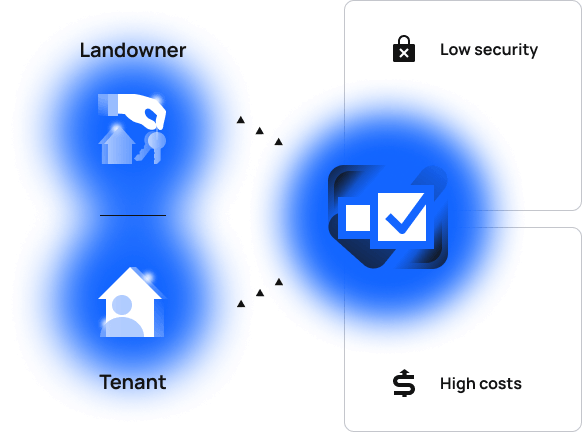

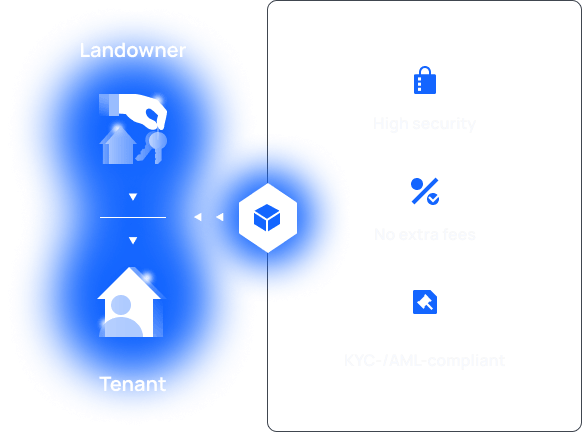

In modern real estate processes, landowners and tenants slowly make deals since both parties have to manually perform background checks before entering into an agreement.

Blockchain reduces the time and costs associated with property deals, guaranteeing regulatory compliance, low prices, and cryptographic protection to all agreement parties.

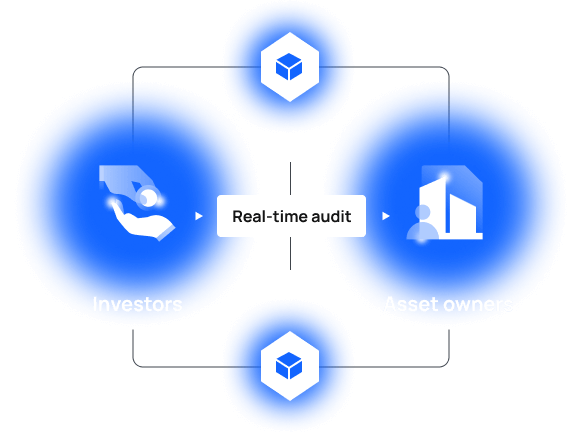

Manual accounting, taking place between investors and asset owners, is a redundant, inefficient process, implying a tedious check of piles of related documents.

Blockchain replaces manual checks with a real-time audit of real estate deliverables, thus making validations fast and efficient.

Shoot us an email with your request, and we will contact you within one business day.