Asset tokenization

development company

Turn any asset into regulated digital tokens. As an asset tokenization company, we bring fractional ownership and global investor access through our asset tokenization services.

Tokenize assets with Aetsoft

Asset tokenization development company

Use cases

Any real world asset can be tokenized for better liquidity and fractionalization.

Types of real world assets tokenized by Aetsoft

Financial assets

Tangible assets

Intangible assets

Choose your networks,

choose your token standard

Custom smart contracts

Purpose-built contracts for your business logic. We strip it down to the essentials and build something that won’t break when the pressure shows up.

Public and private

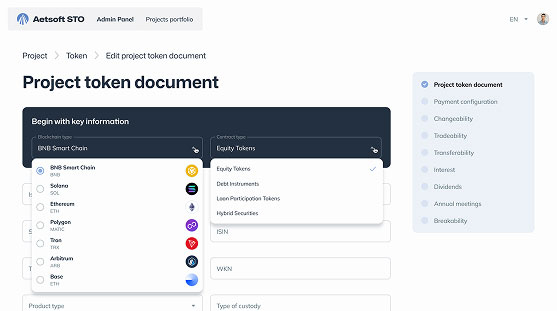

Deploy on major public networks or launch in a controlled permissioned environment. We even build custom blockchains.

Multichain

Launch on one chain or many. Add new networks without re-architecting your stack.

White label

Own your platform and tokenize regulated real world assets in weeks. Licensing included.

No-code tokenization

via white-label asset tokenization platform

Issue licensed, compliant tokens in weeks

Wherever you are with asset tokenization

company

001

Skip 12-18 months

of licensing wait

With our legal umbrellas you can launch your token in weeks.

002

Meet your local legal

partners

Access our global ecosystem of legal partners and issue tokens for real world assets worldwide.

003

Let us take care

of compliance

On-chain KYC/KYB, AML checks, document capture, and audit trails embedded into smart contracts.

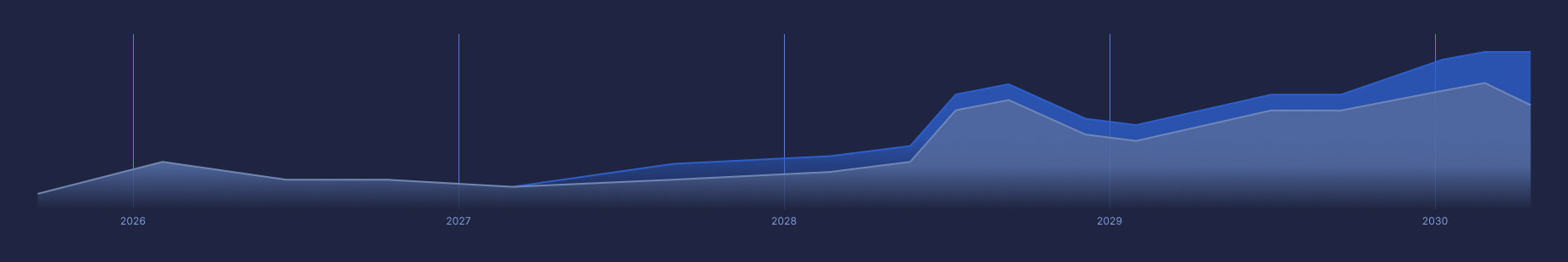

McKinsey

report

Base RWA tokenization scenario by 2030.

Join a $2 trillion

market in the making

Partner

ecosystem

We’ve spent +10 years doing the groundwork. You get the legal, technical, and compliance backbone without wasting time on what’s already been solved.

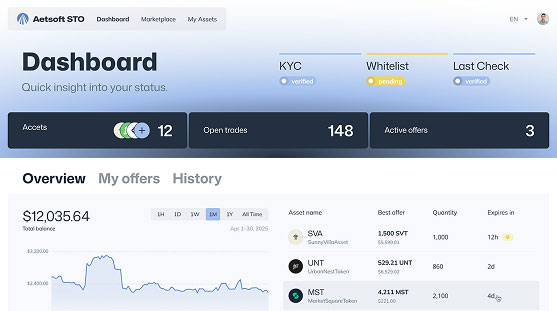

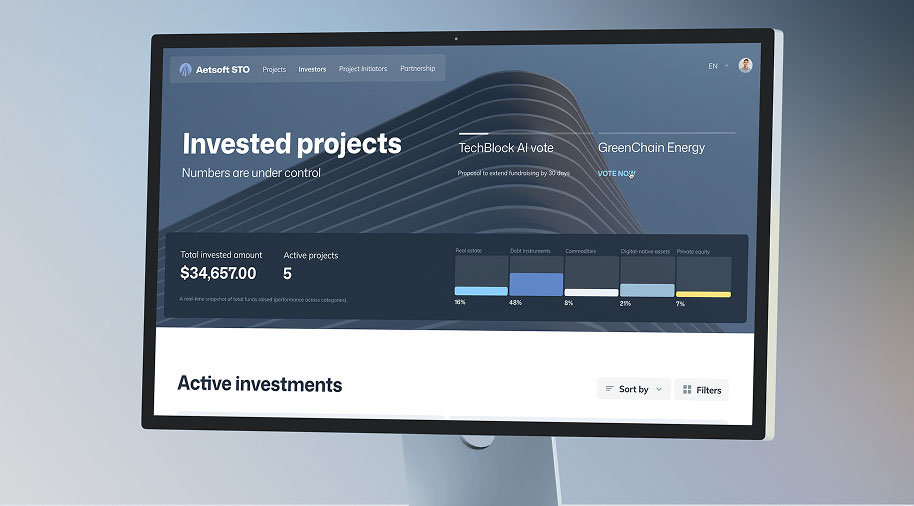

Aetsoft STO ecosystem

Frequently asked questions about

asset tokenization development

-

What is asset tokenization?

Asset tokenization turns real assets into digital tokens recorded on blockchain. These tokens represent ownership or rights. It makes assets easier to trade, share, and manage across global markets.

-

What are the benefits of asset tokenization platform development?

With our white label tokenization platform you can tokenize assets in weeks. You get the entire source code under a commercial license.

If you need a custom asset tokenization platform, we can build it from scratch. This way you get full IP rights over the platform. -

What modules and components does a digital asset tokenization platform need?

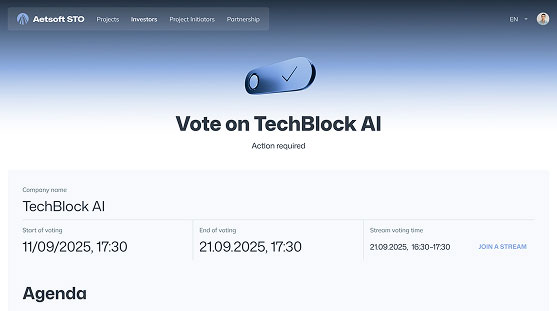

A complete platform typically covers issuance, compliance (KYC/AML), investor onboarding, custody, payments, reporting, corporate actions, and connections to secondary markets.

-

What types of assets can be tokenized?

We support a wide range of financial, tangible, and intangible assets. This includes funds, equity, debt instruments, real estate (also via real estate nft marketplace), commodities, art, collectibles, intellectual property, royalties, and energy or carbon credits.

-

What token standards exist for asset tokenization platforms?

Most platforms rely on widely used standards such as ERC-20 (fungible tokens), ERC-721 (non-fungible tokens), and ERC-1155 (multi-asset tokens), with adaptations for regulated securities.

-

How does asset tokenization provide liquidity and fractional ownership?

Tokenization breaks assets into smaller units, allowing investors to buy fractions instead of the whole. These tokens can then be traded, opening liquidity for markets that used to be locked.

-

How long does tokenization take?

With our no-code platform and regulatory frameworks in place, tokenization development can be completed in a matter of weeks. Traditional processes can take months or even years, so you save significant time.

-

Is the platform compliant with regulations?

Yes. All tokenized instruments are structured in alignment with applicable securities laws and financial regulations. We partner with licensed custodians and legal experts to ensure compliance across jurisdictions.

-

Do investors need technical knowledge of blockchain?

No. Investors can buy and hold tokenized assets as easily as using any online platform. They don’t need to understand wallets, keys, or blockchain mechanics — our platform manages the complexity in the background.

-

Which networks can I issue tokens on?

You can issue across public, private, and permissioned DLT networks depending on your requirements. The platform supports interoperability, so assets remain flexible and tradable.

-

How is custody and security handled?

We provide institutional-grade custody and wallet management solutions. This makes real world assets secure, accessible, and fully compliant with regulatory requirements.

-

Can tokenized real world assets be traded on secondary markets?

Yes. You’re free to list your tokens on any STO friendly exchange. And if you need your own venue, we can build a custom secondary trade marketplace.