P2P lending

software

development

services

Build your peer to peer lending platform to streamline your lending business! We change your daily operations, such as credit scoring, loan calculation and origination, in-process management, and more via automation algorithms and advanced security tools.

Industry leaders trust us

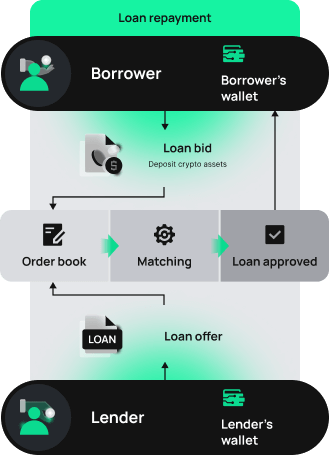

How does P2P lending work?

Request your P2P lending solution today

KYC & AML compliance

Exclude illegal activities by securing your system with advanced identity verification and location-based tools, such as KYC and AML.

Automated escrow system

Ensure reliable funding deals with minimum supervision by embedding a smart contract-based escrow system where operations like funds locking or releasing are executed once specific agreement terms are met.

Intelligent credit scoring

Delegate the creditworthiness' assessment of each client to smart algorithms that run real-time background checks across versatile data sources (both traditional and alternative ones) to get a complete, unbiased picture.

Real-time loan calculation

Facilitate loan management with equated monthly installments calculated based on the client’s specific parameters (credit history, income, payment performance, etc.).

Automated loan charging

Renew loans without manual calculations and possible ‘human errors’ by enabling automated loan renewal and loan order additions.

Advanced borrower management

Streamline borrowers’ search for lenders by providing self-composed client recommendation lists based on the specific conditions and lending limit set.

Flexible lending limits

Calculate lending limits individually per each client based on their income and tax to check if they are eligible for the requested amount of the loan.

Hot wallets

Enable multi-currency payments for lenders and borrowers to pay in a preferred currency thanks to the support of digital hot wallets that ensure fast and seamless transactions.

-

KYC & AML compliance

Exclude illegal activities by securing your system with advanced identity verification and location-based tools, such as KYC and AML.

-

Automated escrow system

Ensure reliable funding deals with minimum supervision by embedding a smart contract-based escrow system where operations like funds locking or releasing are executed once specific agreement terms are met.

-

Intelligent credit scoring

Delegate the creditworthiness' assessment of each client to smart algorithms that run real-time background checks across versatile data sources (both traditional and alternative ones) to get a complete, unbiased picture.

-

Real-time loan calculation

Facilitate loan management with equated monthly installments calculated based on the client’s specific parameters (credit history, income, payment performance, etc.).

-

Automated loan charging

Renew loans without manual calculations and possible ‘human errors’ by enabling automated loan renewal and loan order additions.

-

Advanced borrower management

Streamline borrowers’ search for lenders by providing self-composed client recommendation lists based on the specific conditions and lending limit set.

-

Flexible lending limits

Calculate lending limits individually per each client based on their income and tax to check if they are eligible for the requested amount of the loan.

-

Hot wallets

Enable multi-currency payments for lenders and borrowers to pay in a preferred currency thanks to the support of digital hot wallets that ensure fast and seamless transactions.

Why choose us for P2P lending software development

Experts in software

and business

Our p2p lending platform development company has been developing custom lending solutions long enough to know that you need experts who understand business, not just code.

Focus

on you

We start with what you need, then identify the right tools. You’re welcome at meetings, you’ll get regular reports, and your feedback is vitally important. We build solutions for your business.

Deep development

skill base

With a team of expert developers, our p2p lending software development company delivers best-in-class solutions across codebases and libraries.

We’re still learning,

too

Your business doesn’t stand still. Neither do we. We’re constantly improving our skills and understanding to deliver cutting-edge advice and services.