Real estate

tokenization company

Issue regulated, compliant real estate securities globally in weeks.

Need guidance through regulatory landscapes? Let’s figure out

licensing and compliance strategy

for your token offering

Discuss regulation and

compliance with experts

Use cases

Real estate tokenization brings liquidity and global access to one of the world’s most illiquid markets.

Why tokenize real estate

Use cases

001

Crowdfund a development

Property developers have limited funding sources and long timelines. Tokenization opens new-build projects to a global pool of investors and microinvestors.

Use cases

004

Crossborder investment

Simplify ownership for foreign investors. Let them buy stakes in international land and property as easily as local ones.

Use cases

005

Offer collateralized debt

Package loans (bridge, construction, mortgages) into tokenized tranches. Automate payments and expand your capital sources.

Use cases

006

Tokenize income-streams

Tokenize future cash flows (rent, lease fees, service charges) to give investors a yield instrument and you upfront liquidity.

White label

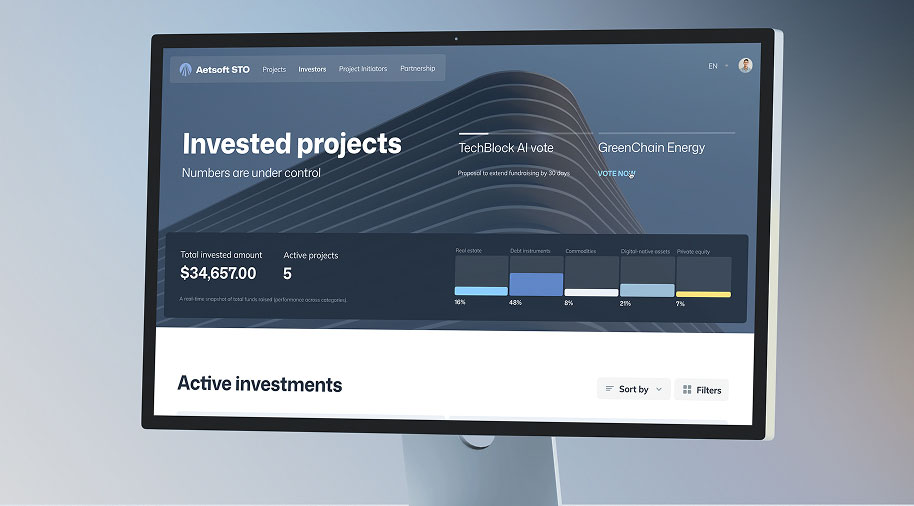

Our ready-made STO infrastructure lets you tokenize assets instantly with all the tech built, tested, and security-audited. We also help you with the initial legal set up which usually takes around 2 weeks.

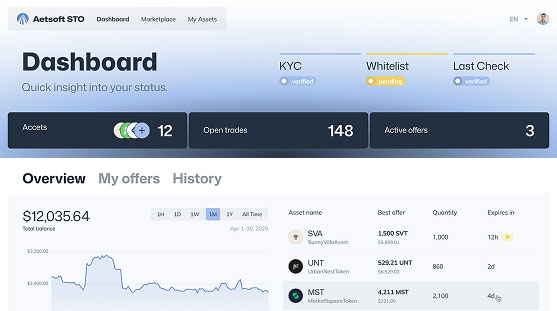

Aetsoft STO: White-label real estate tokenization platform

With Aetsoft, real estate tokenization is legal

001

Skip 12-18 months

of licensing wait

With our legal umbrellas you can launch your security token offering in weeks.

002

Meet your local legal

partners

Reach a global ecosystem of legal partners and issue security tokens worldwide.

003

Let us take care

of compliance

On-chain KYC/KYB, AML checks, document capture, and audit trails embedded into smart contracts. Tailored for real estate offerings.

Plan your issuance and secondary trading setup in 30 minutes. Share the asset, jurisdiction, and investor type. We’ll outline the end to end flow and the best first release

“We build the full lifecycle

with compliance built in:

issuance, onboarding, and

secondary trading.”

Deloitte

report

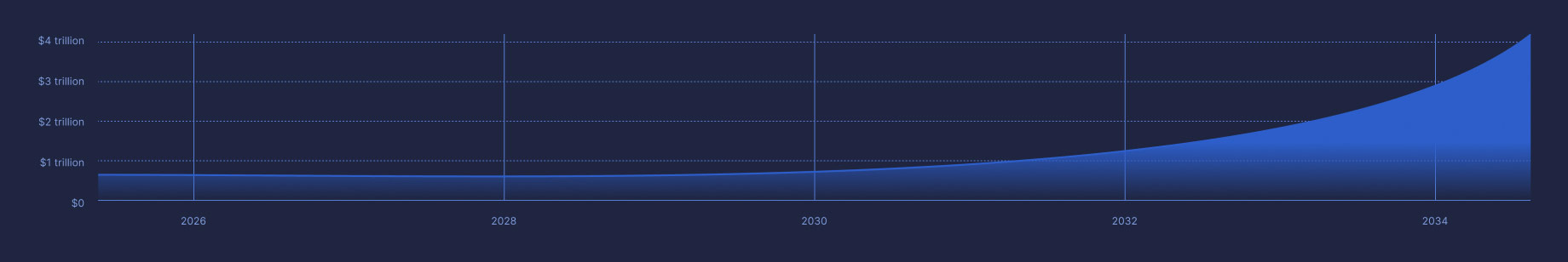

Deloitte predicts that $4 trillion worth of real estate will be tokenized by 2035. It may change the real estate market forever.

Tokenized real estate market is growing

30% yearly

Partner

ecosystem

A decade of Aetsoft partnerships at your back. Your real-estate tokenization project gets instant access to legal, technical, and compliance ecosystem

Aetsoft STO ecosystem

Frequently asked questions about

real estate tokenization

-

Why tokenize real estate with Aetsoft?

Most companies issue utility tokens. We issue regulated security tokens. These are regulated financial instruments enforceable under your jurisdiction’s securities laws.

-

Can real estate tokens be legally enforced?

Yes. Our security tokens are registered and recognized as tradable securities. Aetsoft works with a network of legal partners across the EU, US, and other jurisdictions to ensure each token issuance complies with local securities laws. This includes regulatory filings, investor accreditation checks, and custodial arrangements for asset backing. In many regions, our clients can access ready legal umbrellas that cut the time-to-market to weeks.

Moreover, smart contracts enforce legal terms automatically, so security token offerings are even more enforceable than traditional instruments.

-

Can tokenized real estate be traded?

Yes. Tokenized assets can be traded on compliant secondary markets, either through regulated P2P marketplaces or centralized exchanges (CEX) integrated with KYC/AML verification. These platforms enable fractional resales, giving investors an exit option and improving liquidity in traditionally illiquid property markets. Depending on the jurisdiction, certain holding periods or investor categories (e.g., accredited) may apply.

-

Can I onboard an existing property, REIT or fund to Aetsoft’s platform?

Yes. We handle tokenization of legacy share structures and fund vehicles, preserving your existing investor base and regulatory approvals. Our migration toolkit streamlines the process, minimizing downtime.

-

Is real estate tokenization legal?

Yes. Real estate tokenization is legal when structured under securities and property laws. Aetsoft helps clients issue licensed digital securities that are valid both in the country of issuance and for international investors. Our legal partners in multiple jurisdictions bring licensing and full compliance with KYC/AML from day one.

-

How much does it cost to tokenize real estate?

Basic projects start around $20,000–$60,000 for legal setup, KYC/AML, and token issuance. Mid-tier builds with investor portals and cross-border compliance range $60,000–$150,000, while enterprise platforms with audits and integrations can exceed $150,000–$350,000.

-

Which types of properties can be tokenized?

Practically any real estate asset can be tokenized: residential apartments, commercial buildings, warehouses, land plots, or entire property portfolios. Developers often tokenize future projects to raise capital before construction, while funds tokenize existing assets to improve liquidity and diversify their investor base. Even REITs and SPVs can issue security tokens representing their underlying holdings.

-

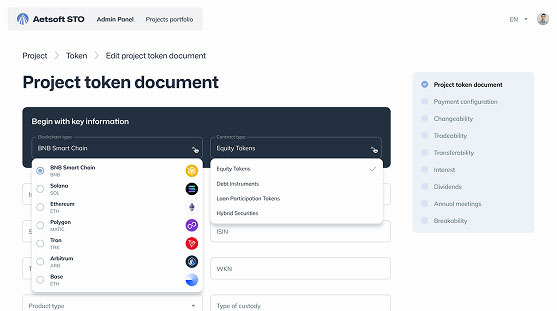

Which blockchains do you support?

Our STO platform is blockchain-agnostic and supports major EVM-compatible networks such as Ethereum, Polygon, and Avalanche, as well as private or hybrid blockchains. The choice depends on your project’s compliance, transaction volume, and investor access goals. For institutional clients, we can also integrate enterprise chains with permissioned access for higher privacy and control.

-

How long does it take to launch a tokenized real estate offering?

Most clients launch within weeks. Since our technology stack is already built and tested, the only waiting period is the licensing process. That’s typically around two weeks, depending on the jurisdiction. Once approval is granted, your branded platform can go live immediately, allowing investors to onboard, subscribe, and trade tokens in a compliant environment.

-

Can I customize the UI or host the platform under my own brand?

Yes. Our white-label platform is fully customizable from dashboard layouts and color schemes to domain name and investor onboarding flow. You can host it on your own infrastructure or let us manage deployment in a secure, compliant environment. This flexibility allows you to deliver a seamless brand experience while we handle all the blockchain, compliance, and backend complexity under the hood.

-

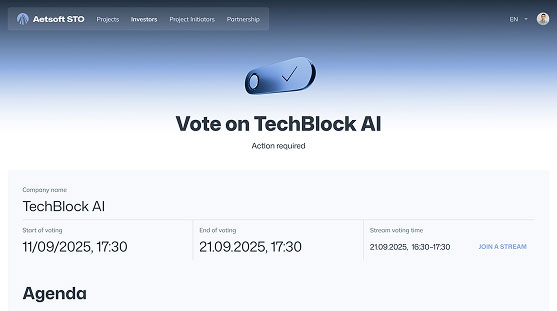

How are corporate actions (like voting or share redemption) handled?

Corporate actions are automated through smart contracts integrated into the STO platform. Investors can vote on proposals, redeem shares, or approve changes directly within the investor portal, with every action recorded transparently on the blockchain. Dividends, buybacks, and other events trigger pre-programmed smart-contract logic. This means, alll transactions are automatically enforced and follow the legal and technical rules defined during setup.

-

What happens if the property is sold or revalued?

When a tokenized property is sold, the proceeds are automatically distributed among token holders based on their fractional ownership. We use on-chain settlement or linked custodial accounts. If the property is revalued, updated valuation data is reflected in the platform’s investor dashboard, reports, and smart-contract registry. In cases where revaluation impacts dividends or yield calculations, the platform adjusts payouts accordingly to keep all investors aligned with the asset’s real-world performance.

-

What’s the difference between the white-label platform and custom STO development?

The white-label STO platform is an out-of-the-box solution designed for quick deployment. It comes with built-in compliance, onboarding, issuance, and secondary-market features. You simply brand and configure it to your project.

Custom STO development is a fully tailored service. We design and build every component from scratch to match complex or non-standard tokenization models. It’s ideal for enterprise projects that need full IP rights on the platform but also for projects with functionality: custom smart contracts, UX, API integrations, and legal alignment.