Tokenized equity

Issue licensed, fully compliant tokenized equity: both private and public.

Need help starting out? We’ll help you define the licenses, financial model, and technology your project needs

Tokenized equity consulting

Use cases

We believe that ownership shouldn’t be limited by borders, intermediaries, or paper. That’s why we bring accessible programmable liquidity to private and public markets.

Why tokenized equity

Use cases

001

Equity

crowdfunding

Turn private shares into digital equity and raise from hundreds of investors with minimal checks.

Use cases

002

Tokenization

of SPV

Launch project-specific vehicles on-chain. Fund real estate, energy, or private projects with transparent ownership and programmable returns.

Use cases

003

Equity

as collateral

Turn equity into working capital. Use tokenized equity as collateral to access credit lines or loans while keeping ownership intact.

Use cases

006

Tokenization

of stocks

Bridge traditional markets with digital rails. Represent public stocks as tokens to enable 24/7 trading and instant settlement.

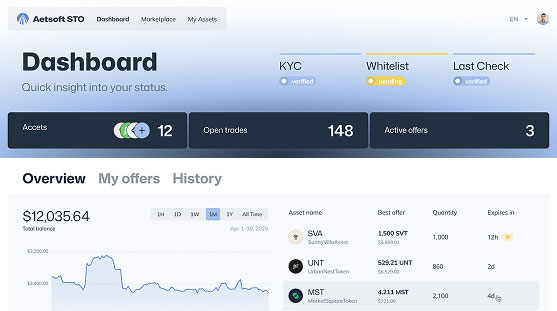

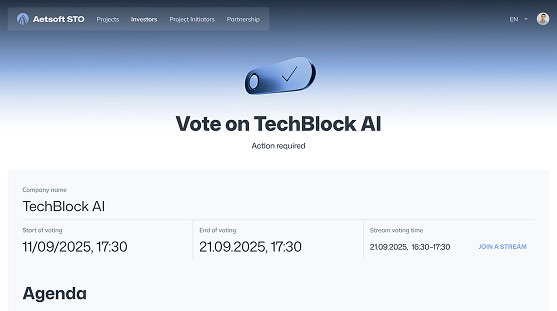

White label

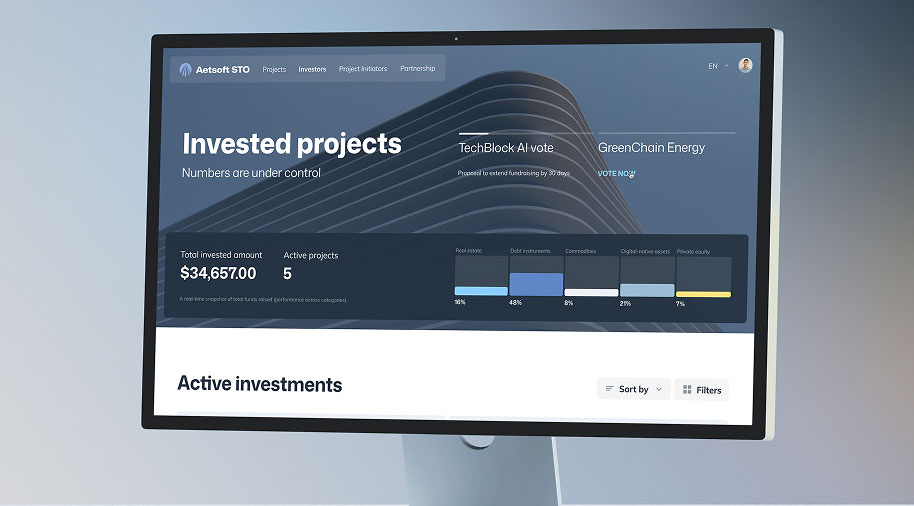

Set up your equity token offering in weeks. All the infrastructure, none of the friction with licensing, technology, and financial set up under one roof.

Aetsoft STO:

White label equity tokenization platform

All legal aspects taken care of

001

Skip 12-18 months

of licensing wait

Get a legal umbrella to launch your security token offering in weeks. Use our legal umbrellas while you wait for your own license.

002

Meet your local legal

partners

Reach a global ecosystem of legal partners and issue security tokens worldwide.

003

Let us take care

of compliance

On-chain KYC/KYB, AML checks, document capture, and audit trails embedded into smart contracts. Tailored for real estate offerings.

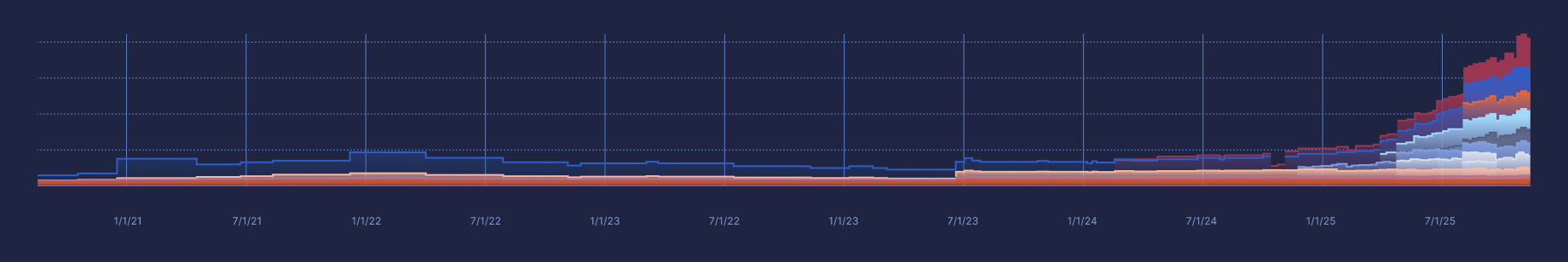

Research

2025 > 2026. Institutional capital is finally moving on-chain. Major banks, asset managers, and funds are entering the tokenized market, bringing regulated infrastructure, liquidity, and trust to digital assets.

The institutional era of tokenization begins

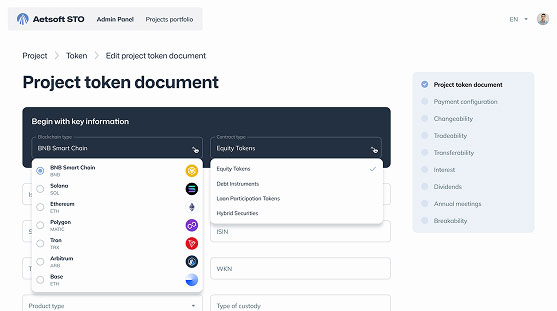

Choose your token structure

We offer white-label stablecoin development solutions for faster launch.

Native tokens

Issue tokens directly onchain, without intermediaries or wrappers. The blockchain becomes the single source of truth for ownership records and cap table management.

Wrapped tokens

Back onchain tokens each token 1:1 with real equity or shares held by a licensed custodian. Each token mirrors the price of the underlying asset.

Synthetic tokens

Track stock prices without holding the actual asset. Tokens use oracle data to offer 24/7 exposure to equities. Perfect for derivatives, leverage, and DeFi strategies.

Partner

ecosystem

A decade of Aetsoft partnerships at your back. Your real-estate tokenization project gets instant access to legal, technical, and compliance ecosystem

Aetsoft STO ecosystem

Frequently asked questions about

tokenized equity

-

What is equity tokenization and how does it work?

Tokenization is the process of converting shares into digital tokens on a blockchain. It’s similar to tokenization of stocks, where each token represents a legal ownership unit and can be issued, transferred, or traded under programmable compliance.

-

How is tokenized private equity different from traditional private equity?

Tokenized equity enables fractional ownership, automated compliance, and easier secondary trading. Unlike traditional private equity, investors can access positions in smaller amounts, and issuers can streamline onboarding, cap-table updates, and settlements.

-

Can public market instruments like stocks and bonds be tokenized?

Yes. Many jurisdictions allow tokenization of bonds and stocks, provided the issuer follows the relevant securities regulations. This allows investors to trade traditional financial instruments on blockchain rails while retaining their underlying rights.

-

What are the benefits of tokenization of stocks for investors?

The tokenization of stocks offers faster settlement, 24/7 market access, fractional ownership, and programmable compliance. Investors gain more flexibility while issuers reduce operational overhead and expand access to global markets.

-

What is tokenization of stocks?

Tokenization of stocks is the process of representing traditional shares as digital tokens on a blockchain. Each token reflects real legal ownership of the underlying stock, allowing faster settlement, fractional ownership, global access, and automated compliance without changing the rights attached to the original security.