Blockchain applications in insurance

-

Claim verification

-

Property insurance

-

Claim notifications

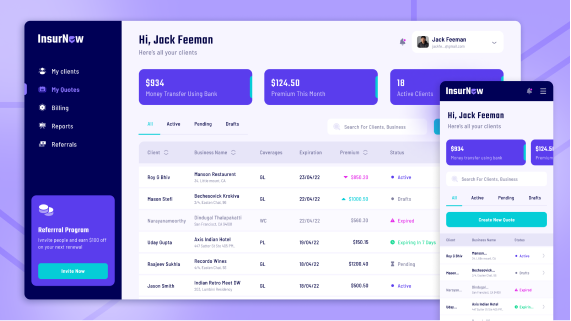

Use case 1. Fast claim verification

Currently

Data distribution across databases hardens due diligence of insurance claims, making their collection a more lengthy process than it could be — with the right tools at hand.

With blockchain

Provide a single database for insurance-related assets — bills, payment and tax receipts, and others — to instantly access them all at once whenever required.

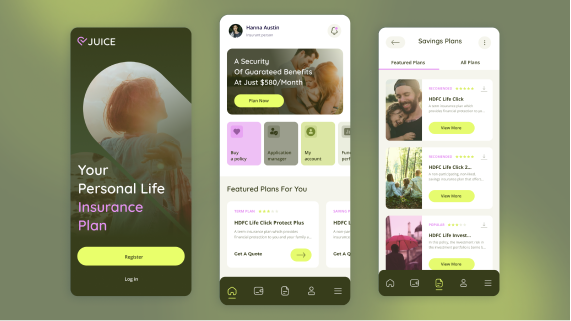

Use case 2. Digital property insurance

Currently

To get insurance, you need to go through a tiresome procedure with piles of papers to fill in and then waiting for their approval and verification.

With blockchain

In travel insurance, contingencies, like trip cancellation, baggage loss, or flight accidents, involve different types of notifications, yet all of them are susceptible to downtime and delays.

Use case 3. Instant claim notifications

Currently

In travel insurance, contingencies, like trip cancellation, baggage loss, or flight accidents, involve different types of notifications, yet all of them are susceptible to downtime and delays.

With blockchain

Blockchain is a universal tool that enables real-time alerts on any force majeure; get updated in an instant!